Latest Facts

Transport

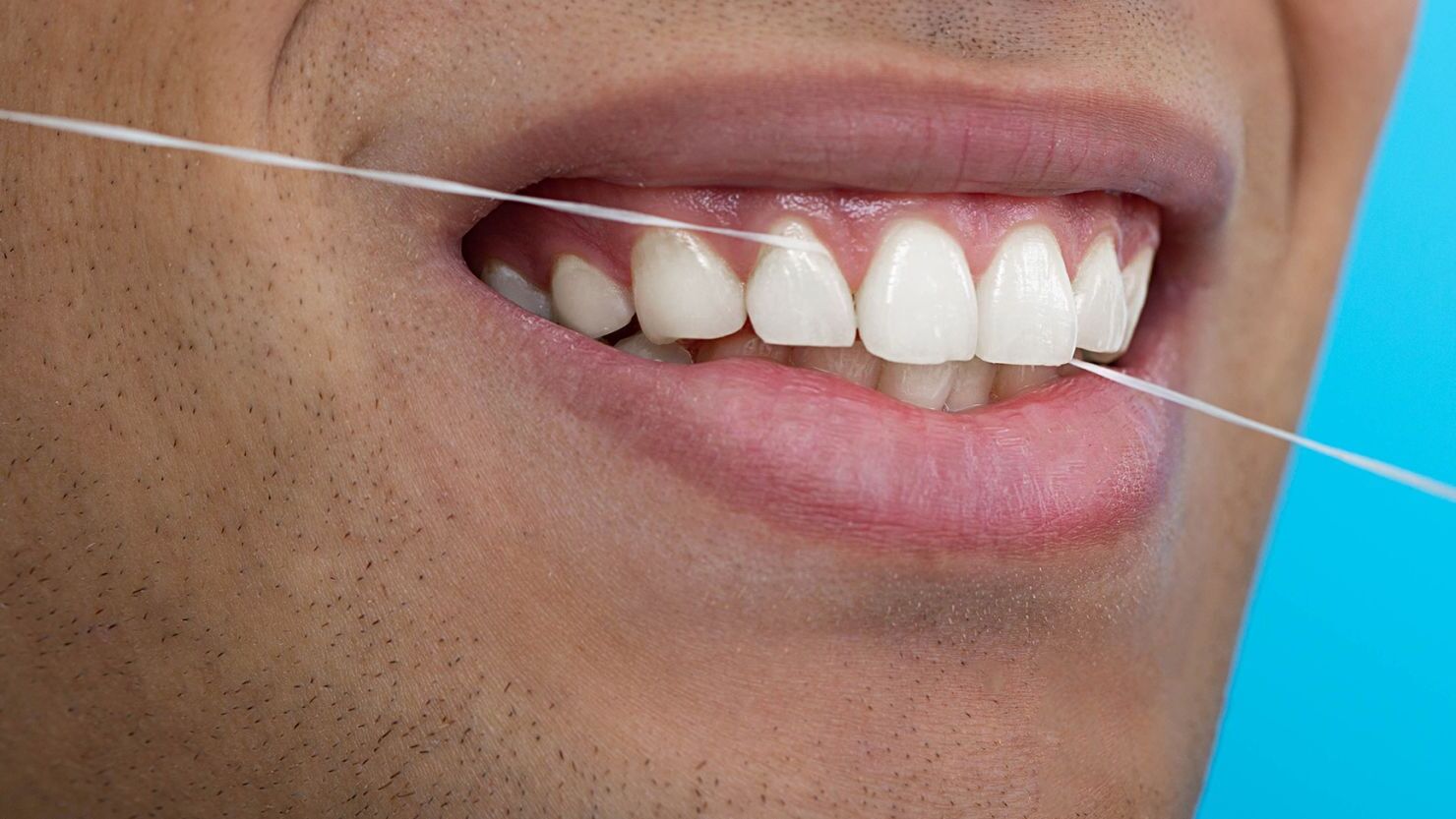

Dentistry

Dentistry

Human Activities

Philosophy

Human Activities

Human Activities

Thinking Skills

Transport

Human Activities

Human Activities

Philosophy

Human Activities

Dentistry

Dentistry

Electronics

Human Activities

Human Activities

Nature

Philosophy

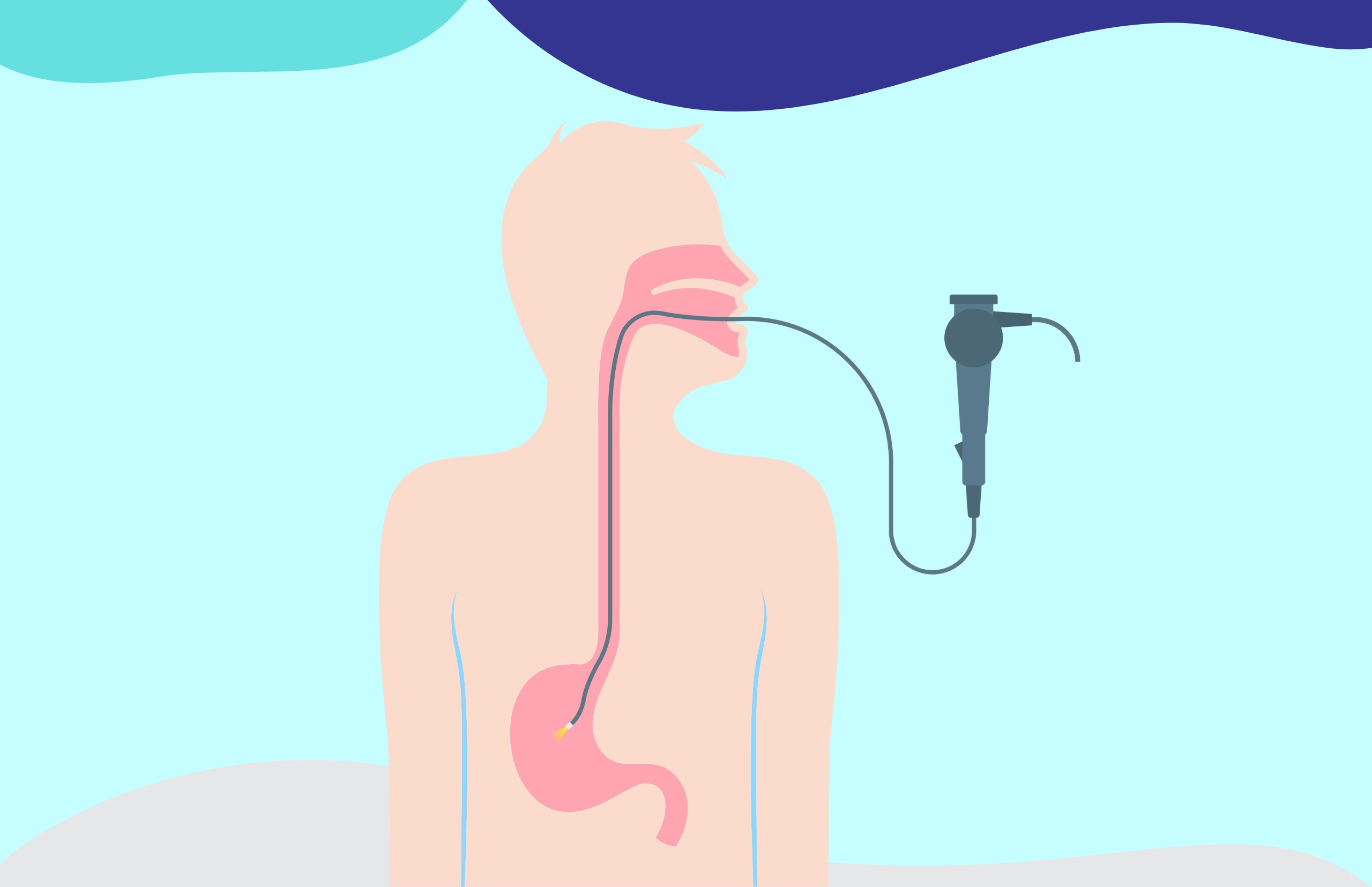

Health

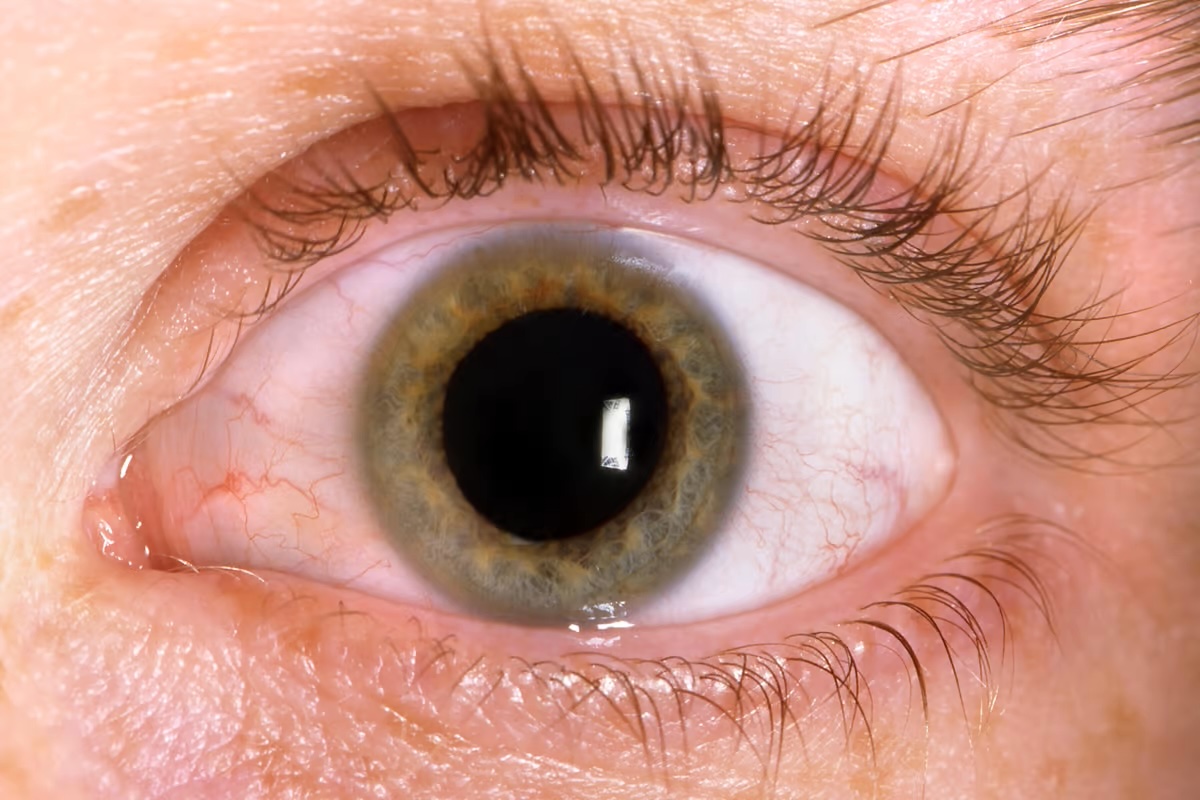

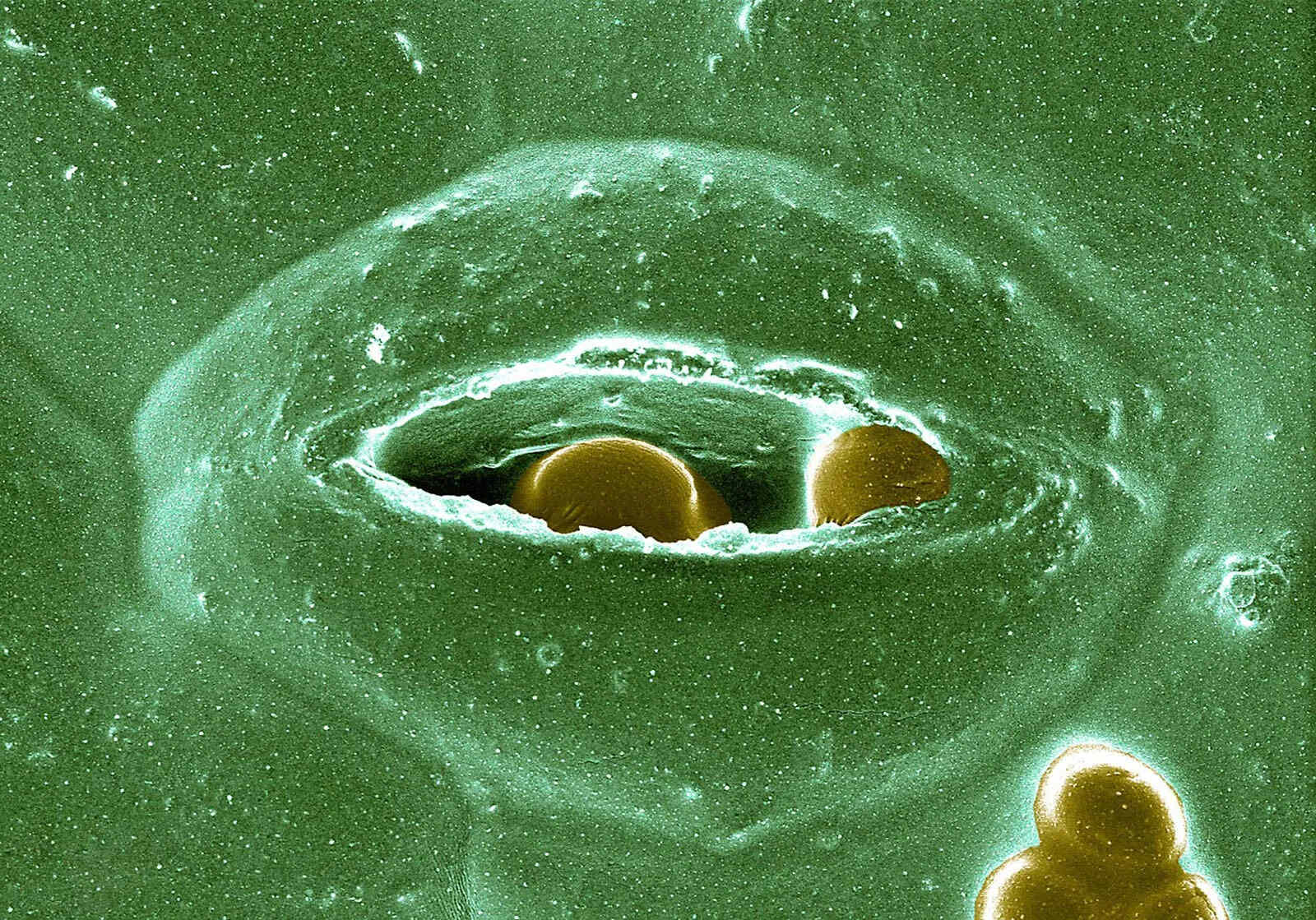

Human Body

Human Body

Philosophy

Human Body

Dentistry

Dentistry

Health

Psychology

Transport

Human Body

Philosophy

Human Body

Health

Physics

Airlines

Human Body

Human Body

Psychology

Human Body

Dentistry

Dentistry

Religion

Human Body

Engineering

Human Body

Human Body

Visual Arts

Human Body

Popular Facts

24 Influential Female Entrepreneurs and Businesswomen

What makes a businesswoman truly influential? Is it her groundbreaking ideas, her ability to inspire others, or perhaps her knack for turning dreams into reality? In this article, we’ll dive […]