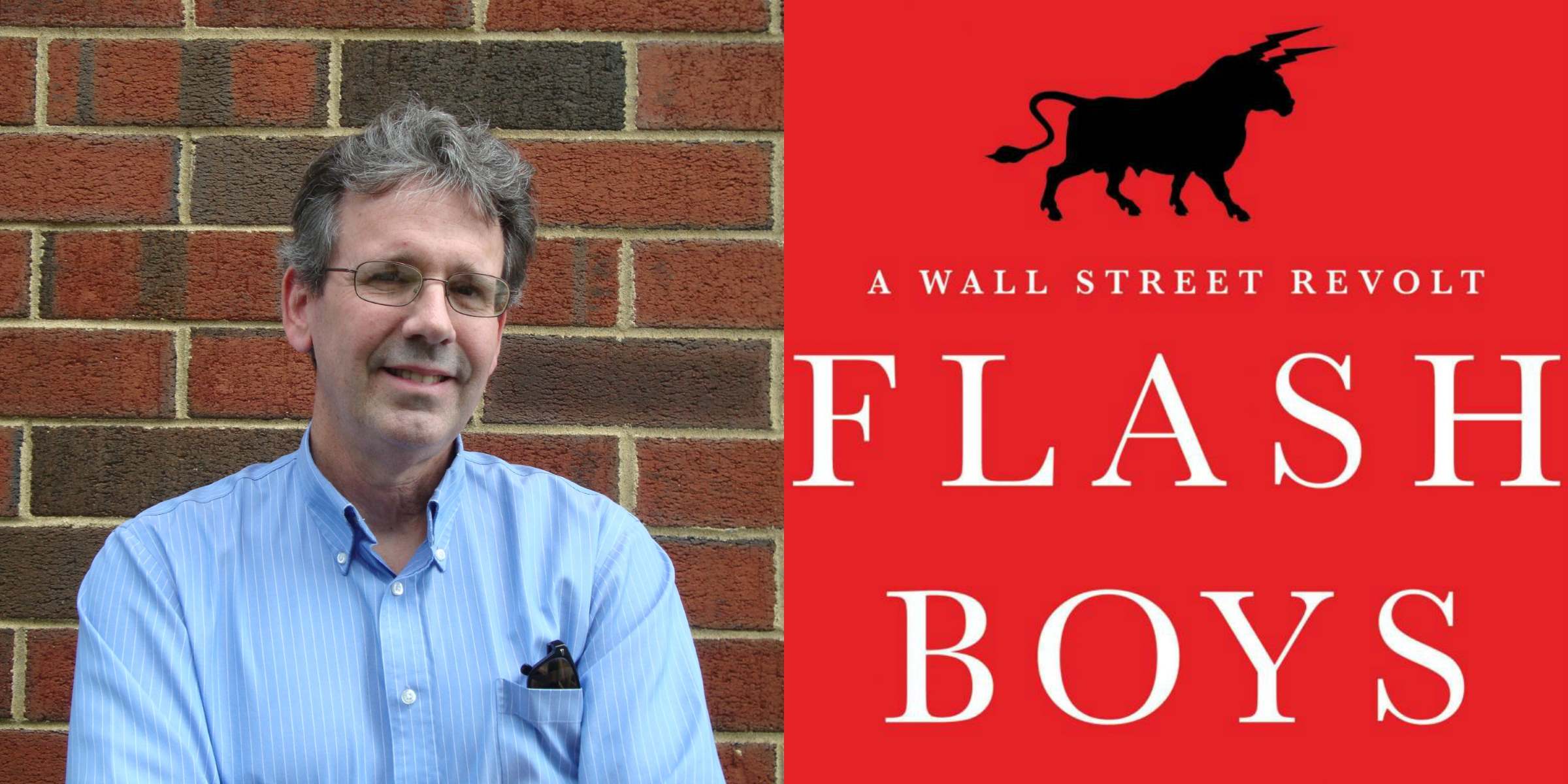

In the world of finance and high-stakes trading, few books have made as big of an impact as “Flash Boys” by Michael Lewis. The book delves into the fascinating and often shocking world of high-frequency trading (HFT) and shines a light on the practices and players behind it. From the dramatic rise of computer-based trading algorithms to the controversial tactics employed by Wall Street firms, “Flash Boys” uncovers a world where milliseconds can mean millions and the odds are stacked against the average investor. In this article, we will explore 14 unbelievable facts that are unveiled in Michael Lewis’ eye-opening book. Prepare to be amazed and perhaps even a bit disillusioned as we delve into the hidden realities of the financial world.

Key Takeaways:

- “Flash Boys” by Michael Lewis uncovers the hidden world of high-frequency trading, revealing unfair practices and the impact on investors. It sparked global attention and calls for market fairness.

- The book’s impact led to legal action, cultural shifts, and even a movie adaptation. “Flash Boys” continues to fuel debates and reforms in the financial industry, shaping the dialogue on high-frequency trading.

The book “Flash Boys” exposes the world of high-frequency trading.

In his remarkable work, “Flash Boys,” Michael Lewis delves into the secret world of high-frequency trading (HFT) on Wall Street. Lewis unravels the complexities of the financial markets and reveals the impact of HFT on investors and the overall market structure.

The protagonist of “Flash Boys” is Brad Katsuyama.

Katsuyama, a Canadian trader working for Royal Bank of Canada, becomes the central figure in Lewis’s narrative. He discovers that the stock market is rigged in favor of high-frequency traders, and he becomes determined to level the playing field for investors.

The creation of IEX, the Investors’ Exchange.

Katsuyama and his team establish a new stock exchange called IEX, designed to counter the advantages of high-frequency traders. IEX introduces a speed bump that slows down orders, allowing all investors a fair chance of executing trades without being front-run by HFT algorithms.

The controversial practice of “front-running.”

One of the shocking revelations in “Flash Boys” is the existence of front-running, where high-frequency traders use their speed advantage to anticipate buy or sell orders and profit from them before they are executed. This unethical practice puts traditional investors at a significant disadvantage.

The impact of HFT on market volatility.

Lewis highlights how high-frequency trading contributes to market volatility. The lightning-fast trading algorithms can trigger sudden price swings and market disruptions, sometimes magnifying the impact of smaller market events.

The rise of “dark pools” in the financial market.

“Flash Boys” reveals the growing popularity of dark pools, private exchanges where institutional investors can trade large blocks of shares away from the public markets. Lewis exposes how dark pools often favor high-frequency traders, leading to further inequalities in the market.

The lawsuit against the U.S. stock exchanges.

Katsuyama and his team decide to take legal action against major U.S. stock exchanges, accusing them of providing unfair advantages to high-frequency traders. This groundbreaking lawsuit shakes the core of the financial industry and raises questions about the integrity of the stock market.

The controversial reaction from the Wall Street establishment.

Following the release of “Flash Boys,” the book ignited a firestorm of controversy. Some within the financial industry dismissed the claims made by Lewis, while others acknowledged the need for greater transparency and fairness in the markets.

The human side of the story.

Amidst the complex world of high-frequency trading, “Flash Boys” also delves into the human stories behind the characters involved. Lewis explores their journeys, motivations, and the personal toll their fight against the system takes on them.

The international impact of “Flash Boys.”

The revelations brought to light in “Flash Boys” resonated globally, sparking investigations and regulatory reforms in various countries. This international response underscored the book’s significance in uncovering the hidden truths of the financial world.

The cultural shift in the financial industry.

Following the release of “Flash Boys,” the book triggered a cultural shift in the financial industry. It led to increased awareness and scrutiny of high-frequency trading practices, prompting greater calls for transparency and fairness in the market.

The enduring legacy of “Flash Boys.”

“Flash Boys” remains a significant work in the realm of finance and has become a touchstone for discussions on market structure and integrity. It continues to shape the discourse around high-frequency trading, investor rights, and the need for a level playing field.

The adaptation of “Flash Boys” into a feature film.

In 2017, it was announced that “Flash Boys” would be adapted into a feature film directed by Ben Jacoby. The movie aims to bring the gripping story to a wider audience and further highlight the issues raised in Lewis’s book.

The ongoing debate on high-frequency trading.

Even years after its release, “Flash Boys” continues to fuel debates and discussions about the merits and drawbacks of high-frequency trading. The book’s impact on the financial landscape remains profound, serving as a catalyst for necessary reforms and ongoing dialogue.

Conclusion

In conclusion, “Flash Boys” by Michael Lewis is a compelling and eye-opening book that sheds light on the hidden world of high-frequency trading. Through captivating storytelling and meticulous research, Lewis uncovers the truth behind the controversial practice and its impact on the financial markets. The book not only exposes the flaws in the system but also explores the efforts of a group of Wall Street outsiders who set out to challenge and reform the industry.Through its thought-provoking narrative, “Flash Boys” invites readers to question the fairness and transparency of the financial system. It challenges the notion of a level playing field, highlighting the disparities and loopholes that exist within the high-frequency trading world. This groundbreaking work serves as a wake-up call, prompting individuals to reevaluate their perceptions of the stock market and the extent to which it is influenced by technology and algorithms.Overall, “Flash Boys” is a must-read for anyone interested in understanding the inner workings of Wall Street and the forces that shape our financial markets. It offers a valuable and fascinating perspective on the world of high-frequency trading and leaves readers questioning the integrity of our current system.

FAQs

Q: What is “Flash Boys” about?

A: “Flash Boys” is a non-fiction book written by Michael Lewis that explores the world of high-frequency trading. It delves into the practices of Wall Street firms that use advanced technology and algorithms to gain an unfair advantage in the financial markets.

Q: What inspired Michael Lewis to write “Flash Boys”?

A: Michael Lewis was inspired to write “Flash Boys” after meeting Brad Katsuyama, a former trader who discovered the inequalities in the stock market and sought to level the playing field. Intrigued by Katsuyama’s story, Lewis decided to delve deeper into the world of high-frequency trading and its impact on the financial industry.

Q: What are the key takeaways from “Flash Boys”?

A: Some of the key takeaways from “Flash Boys” include the revelation of the rigged nature of the stock market, the impact of high-frequency trading on ordinary investors, and the efforts of a group of Wall Street outsiders to challenge and reform the industry.

Q: Is “Flash Boys” a difficult book to understand?

A: While “Flash Boys” delves into the intricacies of high-frequency trading, Michael Lewis presents the complex concepts in a way that is accessible to both finance professionals and general readers. The storytelling nature of the book keeps the readers engaged throughout.

Q: Does “Flash Boys” offer any solutions to the issues it presents?

A: While “Flash Boys” doesn’t provide a clear-cut solution to the problems it uncovers, it does shed light on the need for greater transparency and regulation in the financial markets. The book sparked conversations and debates about the fairness and integrity of the system.

If you're fascinated by the world of finance and trading, don't miss our other captivating articles. Dive into the gripping drama of "Wall Street," explore the intricacies of "financial markets," and uncover surprising "stock market" facts that will leave you amazed. From the silver screen to real-world trading floors, there's always more to learn and discover in the fast-paced realm of finance.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.