When it comes to financial scandals and the collapse of the global economy, one name that often comes to mind is Michael Lewis. His book, “The Big Short,” has captivated millions of readers with its gripping account of the 2008 financial crisis.

In this article, we will dive into the world of “The Big Short” and explore 20 intriguing facts about both the book and its author, Michael Lewis. From the inspiration behind the story to the impact it had on the financial industry, these facts will shed light on the fascinating journey of “The Big Short.

So, grab your popcorn and get ready to learn more about the world of high-stakes finance, Wall Street, and the individuals who predicted the collapse of the housing bubble, as we delve into the remarkable tale that is “The Big Short.

Key Takeaways:

- The Big Short, written by Michael Lewis, uncovers the greed and corruption in the financial industry that led to the housing market crash, making complex financial concepts accessible to all readers.

- The book’s success led to a critically acclaimed film adaptation, sparking a global conversation about the ethics of the financial industry and emphasizing the need for financial education.

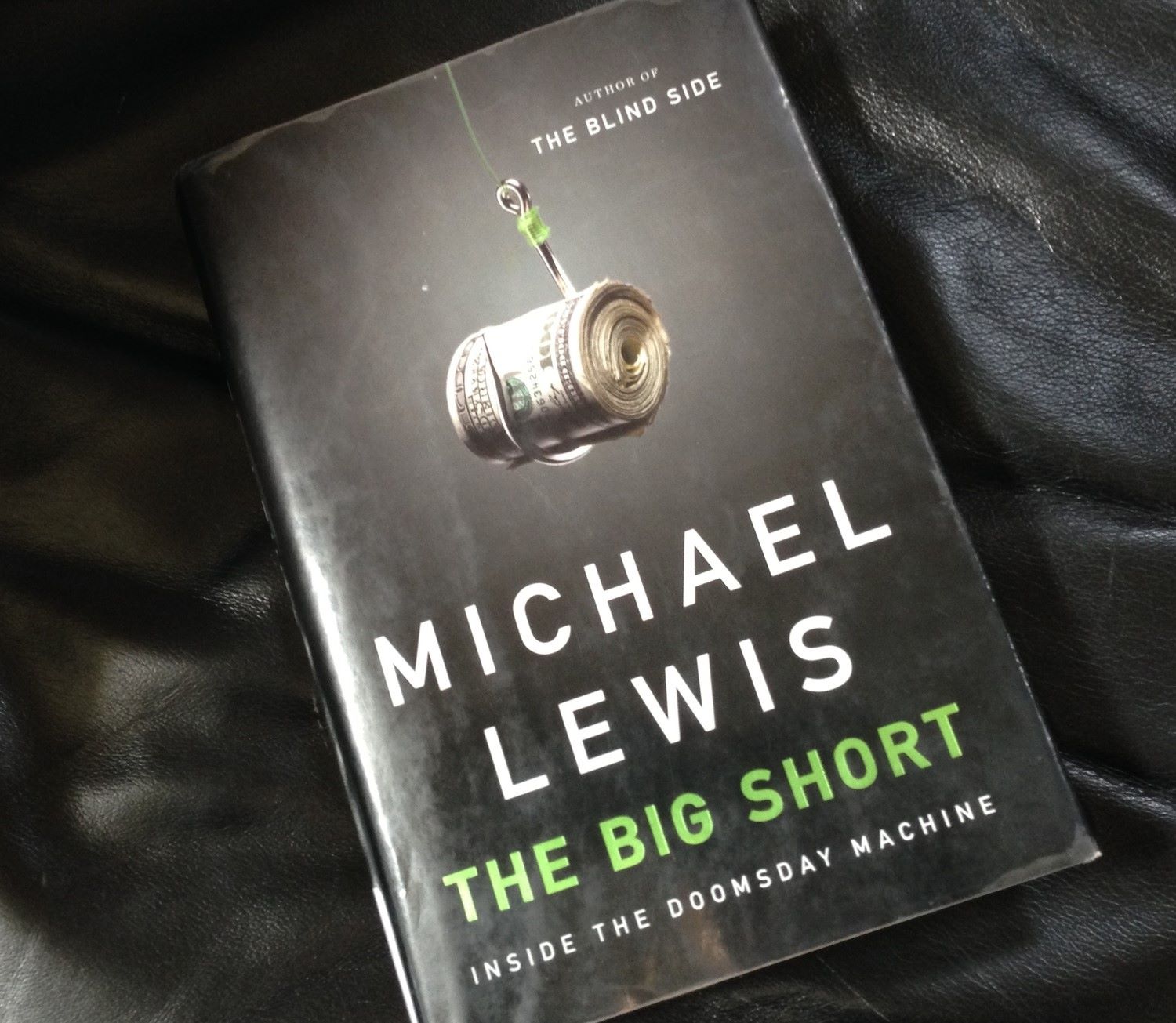

The Big Short was published in 2010.

Written by Michael Lewis, the book delves into the complexities and inner workings of the financial crisis that occurred in the late 2000s.

The book explores the housing bubble.

Michael Lewis takes readers on a fascinating journey, unraveling the events that led to the housing market crash and subsequent economic collapse.

It showcases the financial industry’s greed and corruption.

The Big Short exposes the Wall Street practices that contributed to the crisis, revealing a system driven by greed, excessive risk-taking, and lack of regulatory oversight.

Michael Lewis interviewed key players in the financial world.

Through extensive research and interviews with hedge fund managers, mortgage bond traders, and others, Lewis brings to light the perspectives of those who predicted and profited from the crisis.

It popularized the term “credit default swap.”

The Big Short introduced the concept of credit default swaps to a wider audience, helping to educate readers on the intricacies of these complex financial instruments.

The book was adapted into a critically acclaimed film.

In 2015, The Big Short was adapted into a movie directed by Adam McKay, starring Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt.

It won the Academy Award for Best Adapted Screenplay.

The film received widespread praise for its stellar cast, screenplay, and direction, ultimately winning the prestigious award in 2016.

The character played by Christian Bale is based on a real person.

Bale’s character, Michael Burry, was inspired by the actual hedge fund manager who successfully predicted the housing market collapse.

Michael Lewis makes cameo appearances in the film.

The author of The Big Short can be seen in a few scenes of the movie, adding an extra layer of authenticity to the story.

The real-life protagonists of the book praised its accuracy.

Several of the individuals depicted in The Big Short, such as Steve Eisman and Michael Burry, have publicly commended the book for its faithful portrayal of events.

The Big Short has become required reading in finance courses.

Due to its in-depth analysis of the financial crisis, the book is often included in college and university curricula as an important resource for understanding the complexities of the market.

Michael Lewis has a background in finance.

Prior to becoming a bestselling author, Lewis worked as a bond salesman and later as a financial journalist, giving him invaluable insight into the workings of the industry.

The book sheds light on the dangers of unchecked financial speculation.

The Big Short serves as a cautionary tale, highlighting the risks associated with speculative practices and the potential consequences they can have on the economy.

It sparked a broader conversation about the ethics of the financial industry.

Following the release of The Big Short, there was increased public scrutiny of Wall Street and calls for tighter regulations to prevent future crises.

Michael Lewis is known for his ability to make complex topics accessible.

Through his engaging writing style and knack for storytelling, Lewis simplifies intricate financial concepts, making them understandable to a wider audience.

The success of The Big Short led to renewed interest in Michael Lewis’s other works.

Readers who were captivated by The Big Short often sought out Lewis’s other books, such as “Moneyball” and “The Blind Side,” both of which have also been adapted into successful films.

The Big Short spent weeks on The New York Times bestseller list.

The book’s popularity and critical acclaim propelled it to the top of bestseller lists, solidifying its status as a must-read for anyone interested in finance and current events.

The Big Short has been translated into multiple languages.

Recognizing its global impact, the book has been translated into various languages, allowing readers from different countries to gain insight into the financial crisis.

The film adaptation received positive reviews from critics.

Just like the book, the movie version of The Big Short was highly praised for its powerful performances, witty script, and thought-provoking depiction of the financial crisis.

The Big Short emphasizes the need for financial education.

Through its gripping narrative, the book underscores the importance of understanding the intricacies of the financial world and the potential consequences of financial ignorance.

Conclusion

The Big Short, written by Michael Lewis, is a captivating exploration of the 2008 financial crisis. Through its pages, readers are taken on a journey that exposes the factors leading to the crisis and the individuals who saw it coming. With its engaging storytelling and insightful analysis, this book provides a deep understanding of the complex world of finance and the consequences of unchecked greed.

Through the stories of characters such as Michael Burry, Steve Eisman, and Greg Lippmann, Lewis not only explains the intricate details of the housing and financial markets but also highlights the moral and ethical implications of the crisis. The Big Short serves as a reminder of the importance of financial regulation and the need for transparency within the financial system.

Ultimately, The Big Short is not only a well-researched and informative book, but it also serves as a cautionary tale about the dangers of excessive risk-taking and the fragility of the global economy. Michael Lewis’s work is a must-read for anyone interested in understanding the financial world and its impact on our daily lives.

FAQs

1. What is The Big Short about?

The Big Short is a book by Michael Lewis that explores the events leading up to the 2008 financial crisis and the individuals who predicted and profited from the collapse of the housing market.

2. Who are the main characters in The Big Short?

The book follows the stories of several key characters, including Michael Burry, Steve Eisman, and Greg Lippmann, who recognized the flaws in the housing market and bet against it.

3. What are the key themes of The Big Short?

The book explores themes such as financial greed, the complexity of the housing and financial markets, the failures of the regulatory system, and the ethical implications of the crisis.

4. How does The Big Short contribute to our understanding of the financial crisis?

The Big Short provides a comprehensive and detailed account of the financial crisis, shedding light on the factors that contributed to the collapse of the housing market and the subsequent global economic recession.

5. Is The Big Short suitable for readers without a background in finance?

Yes, The Big Short is written in a way that makes complex financial concepts accessible to readers without a background in finance. Michael Lewis uses storytelling techniques to make the subject matter engaging and understandable.

6. What can we learn from The Big Short?

The Big Short serves as a reminder of the dangers of unchecked greed, the importance of financial regulation, and the need for transparency within the financial system. It highlights the long-term consequences of risky financial practices.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.