Stripes, released in 1981, is a classic American comedy film that has become a cultural icon over the years. Directed by Ivan Reitman and starring Bill Murray, Harold Ramis, and John Candy, this hilarious movie follows the misadventures of a group of misfit soldiers who join the U.S. Army for various reasons.

With its witty humor, memorable lines, and unique blend of comedy and action, Stripes has garnered a dedicated fan base and continues to entertain audiences of all ages. In this article, we will delve into 49 fascinating facts about the making of Stripes, including behind-the-scenes stories, trivia about the cast and crew, and the film’s lasting impact on popular culture.

Key Takeaways:

- “Stripes” is a classic military comedy that launched Bill Murray to stardom. Its humor, quotable lines, and iconic characters continue to entertain audiences and inspire a cult following.

- The film emphasizes friendship, teamwork, and overcoming obstacles, while poking fun at government institutions. It’s a timeless comedy that solidified Bill Murray’s comedic legacy and left a mark on ’80s nostalgia.

Bill Murray’s Breakout Role

Stripes marked Bill Murray’s first leading role in a comedy film, catapulting him to stardom.

Released in 1981

The movie Stripes was released on June 26,

Directed by Ivan Reitman

The film was directed by Ivan Reitman, known for his work on Ghostbusters and Twins.

Written by Harold Ramis and Ivan Reitman

Stripes was co-written by Harold Ramis and Ivan Reitman, who previously collaborated on the hit film Meatballs.

A Military Comedy

Stripes is a military comedy that follows the misadventures of two friends who join the U.S. Army.

John Winger

Bill Murray plays the role of John Winger, a down-on-his-luck civilian who decides to join the Army.

Russell Ziskey

Harold Ramis portrays the character Russell Ziskey, John’s best friend and partner in crime.

Basic Training

The movie showcases the hilarious trials and tribulations of the characters as they endure basic training.

The “EM-50 Urban Assault Vehicle”

One of the iconic elements of the film is the EM-50, a highly modified military vehicle.

Co-stars Warren Oates

Warren Oates delivers a memorable performance as the drill sergeant, Sgt. Hulka.

P.J. Soles as Stella

P.J. Soles plays the role of Stella, a fellow soldier and romantic interest of John.

The Czechoslovakian Border

The plot takes a turn when the characters go on a misadventure to the Czechoslovakian border.

A Resurgence of Interest

Stripes experienced a resurgence of interest following the success of the Ghostbusters franchise.

Memorable Quotes

The film is filled with quotable lines such as “Lighten up, Francis” and “We’re all very different people.

A Cult Classic

Over the years, Stripes has gained a strong cult following due to its humor and charm.

A Box Office Success

The movie was a commercial success, grossing over $85 million worldwide.

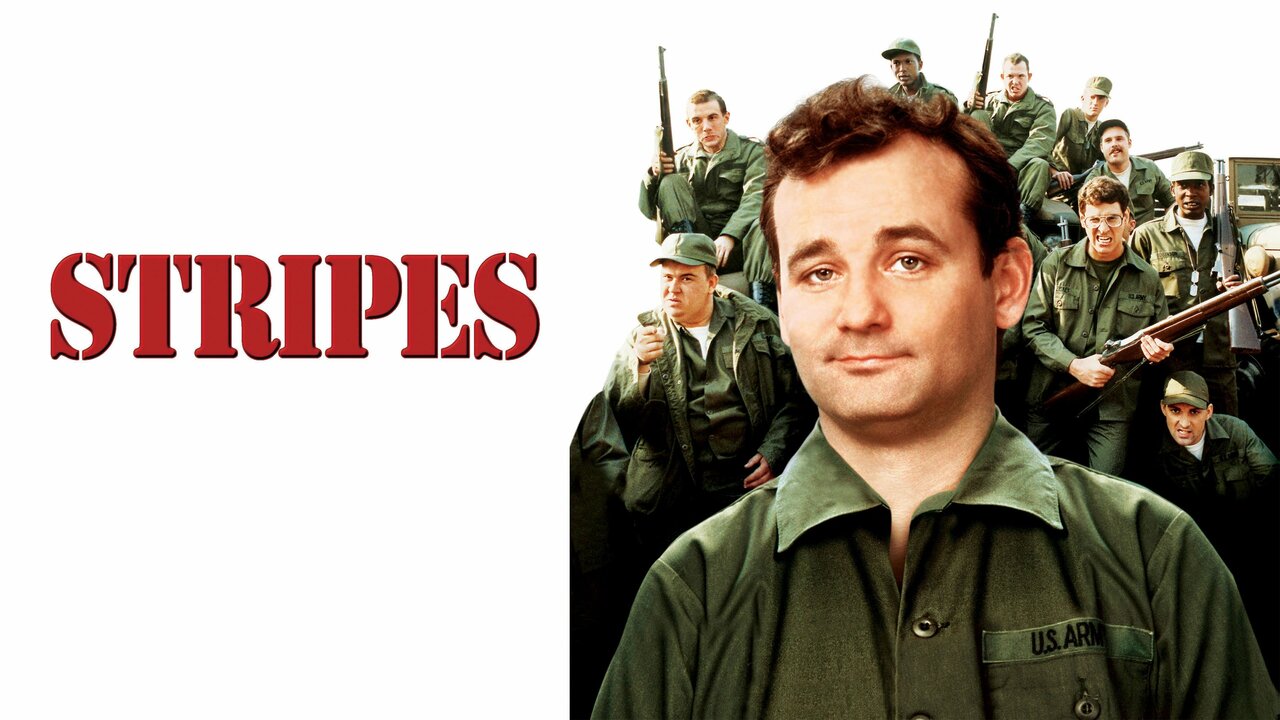

Iconic Poster

The iconic poster features the characters in military uniforms, striking a humorous pose.

Filmed in Kentucky

The movie was primarily filmed in Fort Knox and Louisville, Kentucky.

Music by Elmer Bernstein

The musical score for Stripes was composed by the renowned Elmer Bernstein.

Shooting Range Scene

One memorable scene in the film involves the characters wreaking havoc at a military shooting range.

Army Recruiting Increase

Following the release of Stripes, there was a noticeable increase in Army recruitment.

“That’s the fact, Jack!”

“That’s the fact, Jack!” became a popular catchphrase from the film, often used to convey certainty or agreement.

The Dance Sequence

The film features an iconic dance sequence where the characters showcase their moves in a nightclub.

Harold Ramis’ Impact

Stripes further showcased Harold Ramis’ talent as comedic actor and writer.

The Legacy of Stripes

Stripes paved the way for other military comedy films, such as Full Metal Jacket and Tropic Thunder.

The Slob vs. Straight Man Dynamic

The comedic dynamic between Bill Murray’s slobbish character and Harold Ramis’ straight-laced persona adds to the film’s humor.

The Training Montage

Like many classic ’80s movies, Stripes includes a memorable training montage set to an upbeat soundtrack.

The Battle of East German Border

The climax of the film involves a chaotic battle at the East German border, filled with comedic moments.

The Message

Stripes explores themes of friendship, determination, and the willingness to overcome obstacles.

Stripes 2

Despite rumors over the years, no official sequel to Stripes has ever been made.

The Importance of Camaraderie

Stripes emphasizes the importance of camaraderie and teamwork, showcasing how the characters come together as a unit.

Political Satire

The film incorporates elements of political satire, poking fun at government institutions and military bureaucracy.

The Rainmaker

In one scene, John Winger is seen impersonating a “rainmaker” during a military exercise.

The Honorary MP Status

John Winger and Russell Ziskey are mistakenly made honorary MPs, leading to comical situations.

Bill Murray’s Improvisation

Many of Bill Murray’s lines and actions in the film were improvised, adding to the spontaneity and humor.

The Changing Roles of Women

Stripes depicts how women were starting to play more active roles in the military during the early 1980s.

“And Then Depression Set In!”

One of the film’s most memorable lines is when John Winger exclaims, “And then depression set in!

The Army Graduation Ceremony

The movie culminates with a graduation ceremony for the characters, showcasing their growth and transformation.

The Legacy of Bill Murray

Stripes solidified Bill Murray as a leading comedic actor, setting him on the path to future successes.

The National Lampoon Connection

Stripes shares a connection with the National Lampoon franchise, as both Harold Ramis and Bill Murray were involved in Lampoon projects.

The Spin-Off TV Series

Stripes inspired a short-lived spin-off TV series in 1984 called “Stripes: The Television Series”.

The Supporting Cast

The film features a talented supporting cast, including John Candy, Sean Young, and Judge Reinhold.

The Legacy of Ivan Reitman

Stripes is just one of the many successful films in Ivan Reitman’s extensive career as a director and producer.

The Impact on Pop Culture

Stripes has left a lasting impact on pop culture, with references and parodies appearing in various media over the years.

The Exploration of Masculinity

The film indirectly explores traditional notions of masculinity and male identity through its characters’ journeys.

The Inspiration for Many

Stripes has inspired countless individuals to join the military or consider a career in comedy.

The 80s Nostalgia

The film captures the essence of ’80s nostalgia, with its fashion, music, and comedic style.

The Buddy Comedy Formula

Stripes follows the classic buddy comedy formula, showcasing the comedic pairing of Bill Murray and Harold Ramis.

The Enduring Appeal

Decades after its release, Stripes continues to entertain audiences with its humor, wit, and iconic performances.

The movie Stripes is a military comedy that stars Bill Murray in his breakout role as John Winger. Released in 1981 and directed by Ivan Reitman, the film follows the misadventures of John and his best friend Russell Ziskey, played by Harold Ramis, as they join the U.S. Army. The duo’s journey through basic training is filled with comedic moments, including a memorable dance sequence and chaotic battle at the East German border.

Stripes became a box office success, grossing over $85 million worldwide. It has since gained a strong cult following and is often hailed as a classic. The film showcases the comedic talents of Bill Murray and Harold Ramis, with their slob versus straight man dynamic adding to the humor. The quotable lines and memorable characters have left a lasting impact on pop culture, with references and parodies appearing in various media over the years.

Stripes also explores themes of friendship, determination, and the ability to overcome obstacles. It highlights the importance of camaraderie and teamwork, as the characters come together and grow as a unit throughout the film. The political satire elements in Stripes are evident as it pokes fun at government institutions and military bureaucracy.

Overall, Stripes continues to entertain audiences with its humor, wit, and enduring appeal. It solidified Bill Murray’s position as a leading comedic actor and paved the way for other military comedy films. The legacy of Stripes lives on, inspiring individuals to join the military and leaving an indelible mark on ’80s nostalgia and comedy.

Conclusion

In conclusion, “Stripes” is a comedic gem that has stood the test of time. With its hilarious performances, quotable lines, and memorable characters, it continues to be a beloved film among audiences. Whether you’re a fan of Bill Murray’s dry wit, Harold Ramis’ comedic timing, or simply enjoy a good military comedy, “Stripes” is sure to entertain. From its iconic training sequences to its unexpected twist of saving the day, this film remains an enjoyable watch for both new viewers and longtime fans alike.

FAQs

Q: Who directed the movie “Stripes”?

A: “Stripes” was directed by Ivan Reitman.

Q: When was the movie released?

A: “Stripes” was released on June 26, 1981.

Q: Who are the main cast members of “Stripes”?

A: The main cast of “Stripes” includes Bill Murray, Harold Ramis, Warren Oates, and John Candy.

Q: What is the genre of “Stripes”?

A: “Stripes” is a military comedy film.

Q: Is “Stripes” a successful movie?

A: Yes, “Stripes” was a commercial success, grossing over $85 million worldwide.

Q: Are there any notable quotes from “Stripes”?

A: Yes, some memorable quotes include “We’re Americans, with a capital ‘A’, huh? You know what that means? That means that our forefathers were kicked out of every decent country in the world.”, “And then depression set in.”, and “We’re all very different people. We’re not Watusi. We’re not Spartans. We’re Americans, with a capital ‘A’, huh? You know what that means? Do you? That means that our forefathers were kicked out of every decent country in the world.”.

If you enjoyed learning about Stripes, why not explore more fascinating topics? Discover how boot camp can whip you into shape, both physically and mentally. Uncover surprising facts about Ivan Reitman, the comedic genius behind this classic film. Lastly, take a nostalgic journey through 1980s music and its enduring impact on pop culture. Keep reading to expand your knowledge and appreciation for these captivating subjects!

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.