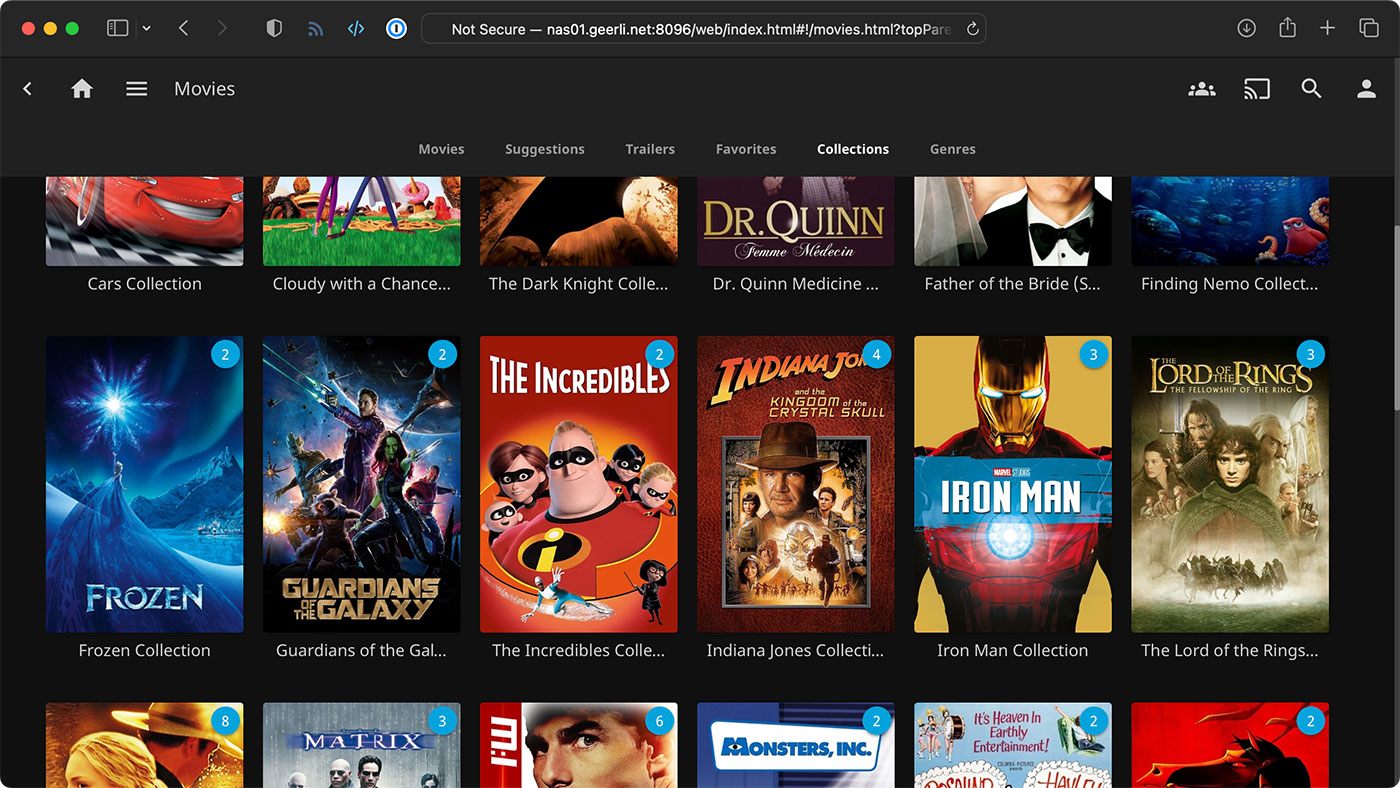

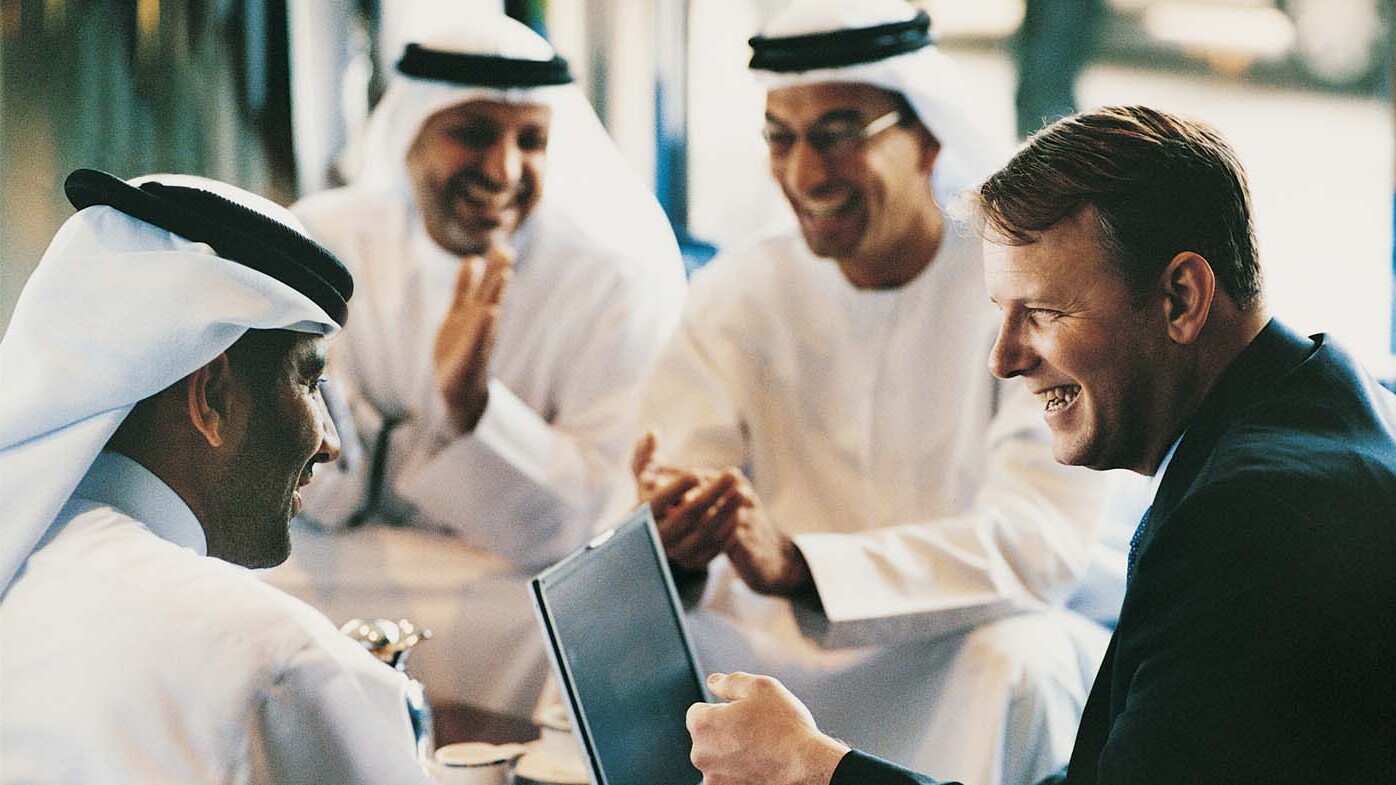

Middle East finance is a complex and dynamic field, reflecting the region's rich history, diverse cultures, and strategic importance in global economics. Middle East finance encompasses everything from oil wealth and sovereign wealth funds to innovative fintech startups challenging traditional banking norms. This region has been at the crossroads of trade routes for centuries, shaping its financial institutions and markets in unique ways. Understanding these 24 facts will not only broaden your perspective on Middle Eastern finance but also highlight its impact on the global stage. From the bustling stock exchanges in Dubai to the venture capital flowing into Beirut's tech scene, get ready to uncover the multifaceted financial landscape of the Middle East.

Understanding Middle East Finance

Middle East finance is a complex and dynamic field, reflecting the region's rich history, diverse cultures, and significant oil reserves. This sector plays a crucial role in the global economy, influencing energy prices, investment flows, and economic development strategies. Let's dive into some fascinating facts about finance in the Middle East.

-

Oil Wealth: The Middle East is home to some of the largest oil reserves in the world. Countries like Saudi Arabia, the United Arab Emirates, and Qatar have built substantial wealth through oil exports, significantly shaping their financial landscapes.

-

Sovereign Wealth Funds (SWFs): Many Middle Eastern countries have established SWFs, state-owned investment funds or entities. For instance, the Abu Dhabi Investment Authority (ADIA) is one of the world's largest SWFs, with assets worth hundreds of billions of dollars.

-

Islamic Finance: This region has been a pioneer in developing Islamic finance, which complies with Sharia law. Unlike conventional banking, Islamic finance avoids interest and emphasizes ethical investments, sharing risk and profit between parties.

Economic Diversification Efforts

In recent years, Middle Eastern countries have been striving to diversify their economies away from oil dependency. This shift involves developing sectors like tourism, finance, and technology.

-

Vision 2030: Saudi Arabia's Vision 2030 is a strategic framework to reduce the country's dependence on oil, diversify its economy, and develop public service sectors such as health, education, infrastructure, recreation, and tourism.

-

Dubai's Financial Hub: Dubai has established itself as a major global financial center. The Dubai International Financial Centre (DIFC) is home to over 2,000 companies and has its own legal system and courts.

-

Fintech Growth: The Middle East's financial technology (fintech) sector is booming, with startups offering innovative services in payments, banking, and investment. Governments are supporting this growth through regulatory reforms and investments.

Challenges and Opportunities

While the Middle East finance sector offers vast opportunities, it also faces challenges such as geopolitical tensions, economic sanctions, and the need for regulatory reforms.

-

Geopolitical Tensions: Conflicts and political instability in parts of the Middle East can impact financial markets and investment flows in the region.

-

Economic Sanctions: Countries like Iran face international economic sanctions, affecting their ability to engage fully in global finance.

-

Youth Unemployment: Despite wealth in some areas, many Middle Eastern countries have high rates of youth unemployment, posing challenges for economic stability and growth.

Innovation and Investment

Middle Eastern countries are increasingly focusing on innovation and investment in technology to drive economic growth and diversification.

-

Startup Ecosystem: The region has a growing startup ecosystem, with significant investments in tech startups. Notable examples include Careem, a ride-hailing app acquired by Uber, and Souq.com, an e-commerce platform acquired by Amazon.

-

Renewable Energy Investments: Recognizing the need to transition to sustainable energy sources, Middle Eastern countries are investing heavily in renewable energy projects, particularly solar and wind power.

-

Smart Cities: Countries like the UAE are investing in smart city projects, using technology to enhance urban living, improve public services, and reduce environmental impact.

Financial Education and Literacy

Improving financial education and literacy is key to fostering economic development and financial inclusion in the Middle East.

-

Financial Literacy Programs: Several Middle Eastern countries have launched initiatives to improve financial literacy among their populations, aiming to enhance personal finance management skills and knowledge.

-

Women's Financial Inclusion: Efforts are being made to increase financial inclusion for women, recognizing their role in economic development. Initiatives include promoting women's entrepreneurship and access to finance.

-

Digital Banking Services: Banks and fintech startups are offering digital banking services, making it easier for people to access financial services, manage their finances, and participate in the economy.

The Future of Middle East Finance

Looking ahead, the Middle East finance sector is poised for continued growth and transformation.

-

Digital Currency Initiatives: Some Middle Eastern countries are exploring digital currencies and blockchain technology to enhance financial services and security.

-

Cross-Border Collaboration: There's an increasing focus on cross-border collaboration in finance, with Middle Eastern financial institutions partnering with global counterparts to expand services and innovation.

-

Sustainable Finance: Sustainable and green finance is gaining traction, with banks and investors focusing on environmentally friendly projects and investments.

-

Regulatory Reforms: Ongoing regulatory reforms aim to improve the business environment, attract foreign investment, and foster economic growth.

-

Increased Global Integration: Middle Eastern financial markets are becoming more integrated with global markets, offering new opportunities for investors and businesses.

-

Education and Talent Development: Investing in education and talent development is crucial for sustaining growth in the finance sector, with universities and institutions offering specialized finance and business programs.

-

Tourism and Real Estate Development: Investments in tourism and real estate are contributing to economic diversification, creating new opportunities in finance related to property development and hospitality.

-

Technology Adoption in Banking: Banks in the Middle East are rapidly adopting new technologies, such as artificial intelligence and machine learning, to improve services and operational efficiency.

-

Challenges of Economic Diversification: While efforts to diversify economies are ongoing, the transition away from oil dependency remains a significant challenge, requiring strategic planning and investment in non-oil sectors.

A Final Glimpse into Middle East Finance

We've journeyed through a landscape rich with financial intricacies and economic milestones that define the Middle East. From the towering skyscrapers of Dubai to the bustling markets of Istanbul, this region is a testament to resilience, innovation, and the ever-evolving nature of global finance. Understanding these 24 facts offers more than just insights into banking and investment; it's a window into the cultural and economic heartbeat of a diverse and dynamic region. As we look ahead, the Middle East's financial sector continues to be a pivotal player on the world stage, promising opportunities for growth, development, and collaboration. Whether you're an investor, a financial enthusiast, or simply curious, there's no denying the impact and importance of Middle East finance in today's interconnected world.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.