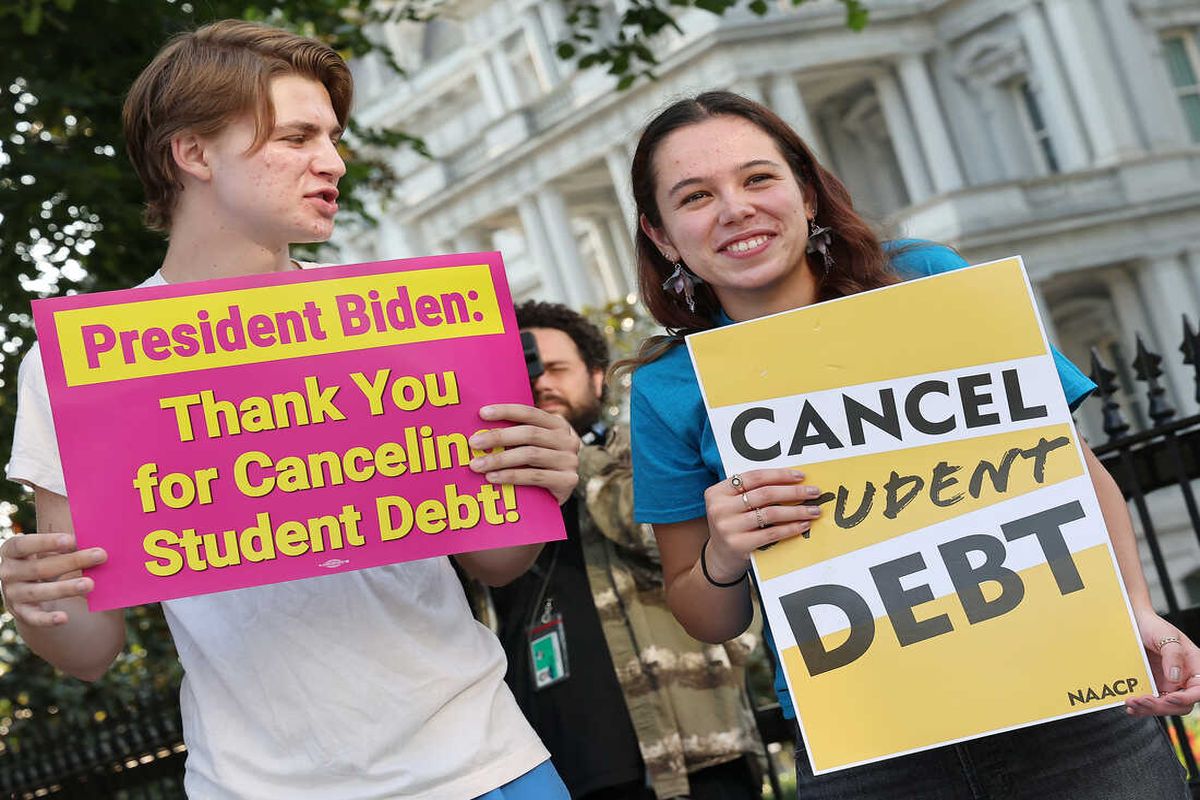

Student loan forgiveness has been a hot topic lately, especially with recent updates. Many students and graduates are eager to know if they qualify for relief. Did you know that certain public service jobs can make you eligible for forgiveness? Or that income-driven repayment plans might lead to loan cancellation after a set period? These updates aim to ease the financial burden on millions. Understanding the latest changes can help you navigate your options better. Stay informed and see if you can benefit from these new policies. Here are 20 essential facts you need to know about the latest student loan forgiveness updates.

What is Student Loan Forgiveness?

Student loan forgiveness can be a lifesaver for many borrowers. It means that part or all of your student loan debt is canceled, and you no longer have to repay it. Here are some key facts about student loan forgiveness.

-

Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

-

Income-Driven Repayment Plans: These plans adjust your monthly payment based on your income and family size. After 20-25 years of payments, any remaining balance may be forgiven.

-

Teacher Loan Forgiveness: Teachers who work in low-income schools for five consecutive years may qualify for forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans.

-

Borrower Defense to Repayment: If your school misled you or engaged in misconduct, you might be eligible for loan forgiveness through this program.

Recent Changes in Student Loan Forgiveness

The landscape of student loan forgiveness is constantly evolving. Recent changes have impacted many borrowers.

-

Temporary Expanded PSLF (TEPSLF): This program provides additional forgiveness opportunities for borrowers who were denied PSLF due to being on the wrong repayment plan.

-

COVID-19 Relief Measures: The CARES Act paused federal student loan payments and set interest rates to 0% temporarily. This pause has been extended multiple times.

-

Simplified Application Process: The Department of Education has streamlined the application process for some forgiveness programs, making it easier for borrowers to apply.

-

Increased Awareness: More borrowers are becoming aware of forgiveness programs due to increased outreach and education efforts by the government and advocacy groups.

Eligibility Criteria for Student Loan Forgiveness

Understanding the eligibility criteria is crucial for anyone seeking student loan forgiveness. Here are some important points to consider.

-

Qualifying Employment: For PSLF, you must work for a government organization, non-profit, or other qualifying employer.

-

Qualifying Loans: Only Direct Loans are eligible for PSLF. Other loans may need to be consolidated into a Direct Consolidation Loan.

-

Qualifying Payments: Payments must be made under a qualifying repayment plan, such as an income-driven repayment plan.

-

Full-Time Employment: You must work full-time for a qualifying employer to be eligible for PSLF.

Common Misconceptions about Student Loan Forgiveness

There are many myths and misconceptions about student loan forgiveness. Here are some facts to set the record straight.

-

Forgiveness is Not Automatic: You must apply for forgiveness and meet all eligibility criteria.

-

Not All Loans Qualify: Only federal student loans are eligible for forgiveness programs. Private loans do not qualify.

-

Forgiveness May Be Taxable: Some forgiven loan amounts may be considered taxable income, depending on the program.

-

Forgiveness Takes Time: Most forgiveness programs require many years of qualifying payments before forgiveness is granted.

The Impact of Student Loan Forgiveness

Student loan forgiveness can have a significant impact on borrowers' lives. Here are some ways it can make a difference.

-

Financial Relief: Forgiveness can provide significant financial relief, allowing borrowers to focus on other financial goals.

-

Career Choices: Forgiveness programs like PSLF can encourage borrowers to pursue careers in public service or non-profit sectors.

-

Mental Health: Reducing or eliminating student loan debt can alleviate stress and improve mental health for many borrowers.

-

Economic Benefits: Forgiveness can boost the economy by increasing borrowers' disposable income and spending power.

Moving Forward with Student Loan Forgiveness

Student loan forgiveness can be a game-changer for many. Understanding the latest updates is crucial. From eligibility criteria to application processes, staying informed helps you make the best decisions. The recent changes aim to make forgiveness more accessible, easing the burden on borrowers. Keep an eye on deadlines and required documentation to ensure you don't miss out.

Remember, each program has its own set of rules. Whether you're a teacher, public servant, or working in a non-profit, there's likely a program that fits your situation. Take advantage of resources available, like financial advisors or online tools, to navigate the process smoothly.

Staying proactive and informed is key. With the right approach, student loan forgiveness can provide significant financial relief, allowing you to focus on your future goals. Keep pushing forward, and don't let student debt hold you back.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.