When it comes to affording a college education, financial aid is often the key to making it happen. But wading through copious amounts of information on federal aid programs and other sources of assistance can be daunting. Here, we break down 19 essential facts about applying for financial aid that you can’t afford to miss. With this comprehensive primer on financial aid in hand, savvy students (and their families) will be well-poised for success when filling out those all-important FAFSA forms. Let’s get started!

Financial Aid Types

Financial aid comes in various forms, including grants, scholarships, work-study programs, and loans. These different types of aid can help cover tuition fees, living expenses, books, and other education-related expenses.

Need-based and Merit-based Aid

Financial aid can be categorized into need-based and merit-based. Need-based aid is determined by the student’s financial need, while merit-based aid is awarded for academic, athletic, or artistic achievements.

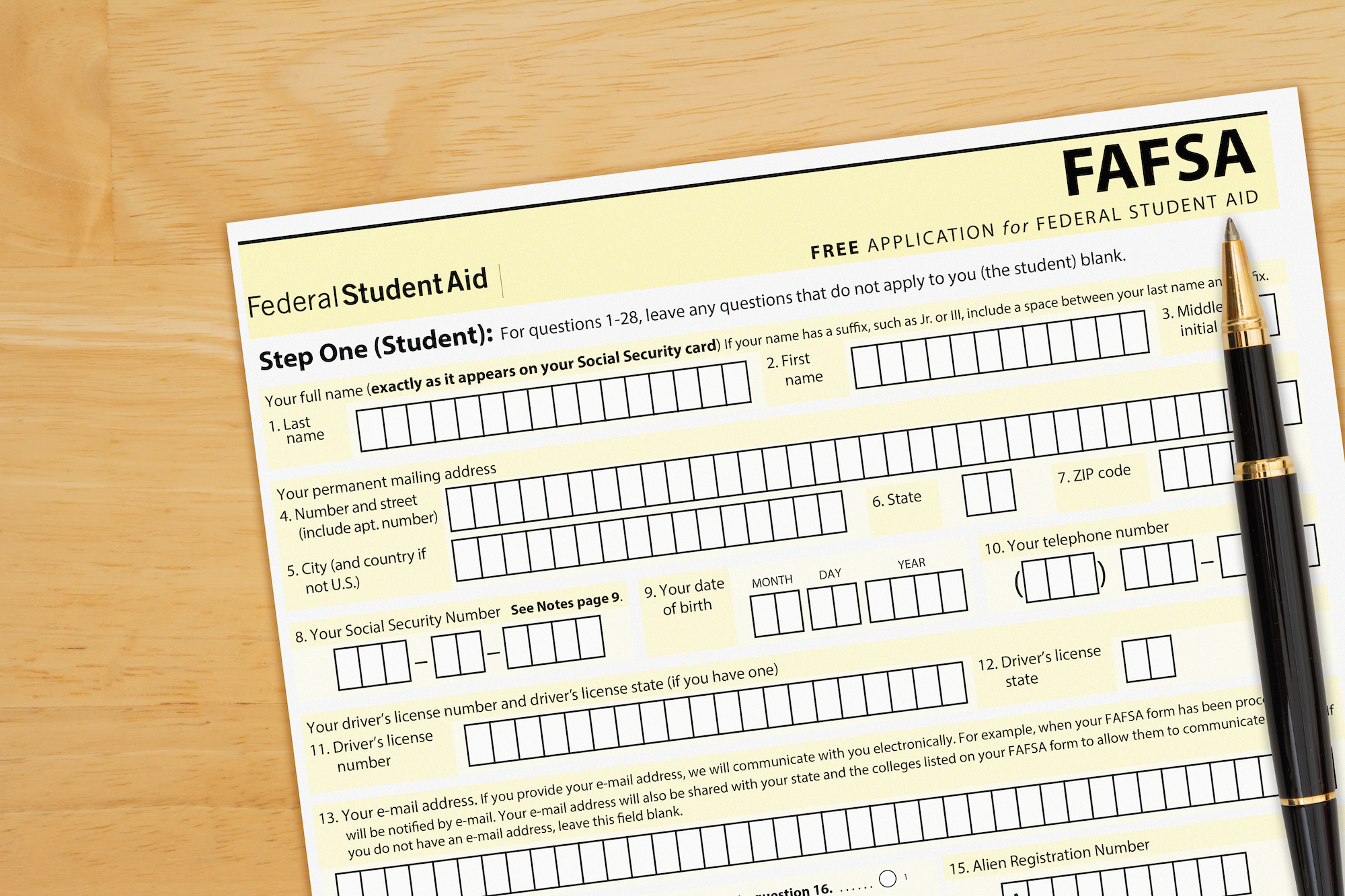

FAFSA – Your First Step

The Free Application for Federal Student Aid (FAFSA) is the primary form used by colleges and universities to determine eligibility for federal, state, and institutional financial aid. It’s crucial to submit the FAFSA as early as possible, as some aid is awarded on a first-come, first-served basis.

Deadlines Matter

Pay close attention to financial aid deadlines. Missing a deadline can result in losing out on valuable aid opportunities.

CSS Profile

The CSS Profile is another financial aid application used by some private colleges and universities to award non-federal financial aid. Be sure to check if the schools you’re interested in require the CSS Profile.

EFC – Estimated Family Contribution

Your Estimated Family Contribution (EFC) is the amount your family is expected to contribute towards your education. The EFC is calculated based on the information provided in your FAFSA and affects your financial aid eligibility.

Award Letters

After submitting the FAFSA, you’ll receive financial aid award letters from colleges that accepted your application. These letters outline the types and amounts of aid you’re eligible for at each institution.

Grants

Grants are a form of need-based aid that doesn’t need to be repaid. The most common federal grants include the Pell Grant, the Federal Supplemental Educational Opportunity Grant (FSEOG), and the Teacher Education Assistance for College and Higher Education (TEACH) Grant.

Scholarships

Scholarships are merit-based aid awarded by colleges, private organizations, and other entities. They can be based on various criteria, including academic achievement, athletic ability, or community involvement.

Work-Study Programs

Federal Work-Study provides part-time jobs for undergraduate and graduate students with financial needs, allowing them to earn money to help pay for education-related expenses.

Loans

Student loans are a type of financial aid that must be repaid, usually with interest. Federal student loans typically have lower interest rates and more flexible repayment options compared to private loans.

Subsidized vs. Unsubsidized Loans

There are two types of federal student loans: subsidized and unsubsidized. Subsidized loans are need-based and do not accrue interest while the student is in school, while unsubsidized loans accrue interest from the time they are disbursed.

Parent Loans

The Federal Parent PLUS Loan is a loan program for parents of dependent undergraduate students to help pay for their child’s education.

Loan Repayment Options

There are various loan repayment options available for federal student loans, including income-driven repayment plans, standard repayment plans, and loan forgiveness programs.

Loan Forgiveness

Loan forgiveness programs can help borrowers who work in certain public services professions, such as teaching or nursing, by forgiving a portion or all of their federal student loan debt after a certain number of years of qualifying employment and loan payments.

Financial Aid Appeals

If your financial circumstances change, you can appeal your financial aid award. Colleges and universities may reconsider your financial aid package if you provide documentation of significant changes in your family’s financial situation.

Scholarships Are Everywhere

There are countless scholarship opportunities available from various sources, such as private organizations, companies, and foundations. Be proactive in your search and apply for as many scholarships as possible to minimize your reliance on loans.

Financial Aid for International Students

International students can also access financial aid, though the options may be more limited compared to domestic students. Scholarships, private loans, and work-study programs are some of the options available for international students.

Stay Informed and Ask Questions

Navigating the financial aid process can be overwhelming, but staying informed and asking questions is crucial. Reach out to your school’s financial aid office, attend financial aid workshops, and consult reputable resources online to ensure you make informed decisions about your education funding.

Conclusion

Affording a college degree can be an intimidating task. It’s important to understand the financial aid process and all of the information that goes with it in order to make it as painless as possible. With this 19-point breakdown of financial aid facts, every student can feel assured their future is within reach. Whether you are planning early or preparing for your final FAFSA submission, make sure you refer back to these facts when applying for financial aid; they will be key in ensuring the journey toward college success is a smooth one. So why wait? Get out there and make those dreams become reality – after all, higher education begins with knowing your finances!

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.