Ever wondered what makes the ONE debit card stand out? This card isn't just another piece of plastic in your wallet. It's packed with features that can make managing your money easier and more rewarding. From cashback rewards to fee-free ATMs, the ONE debit card offers a range of benefits designed to help you get the most out of your spending. Whether you're a frequent traveler, a savvy saver, or someone who just wants a bit more control over their finances, this card has something for everyone. Ready to learn more? Let's dive into 35 facts that make the ONE debit card a game-changer.

What is ONE Debit Card?

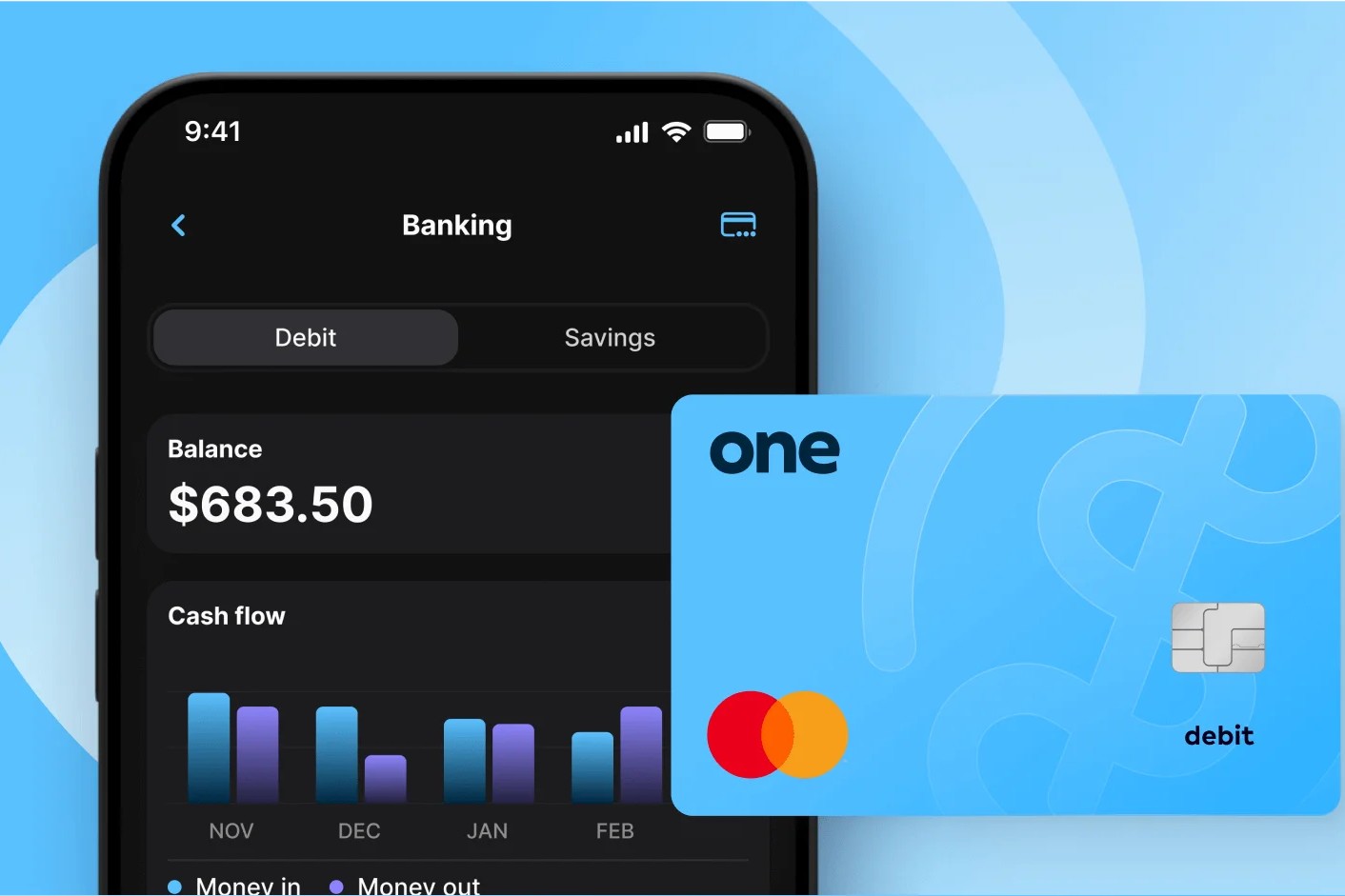

The ONE debit card is a financial tool designed to simplify spending and saving. It offers unique features and benefits that set it apart from traditional debit cards. Here are some intriguing facts about the ONE debit card.

-

The ONE debit card is issued by Coastal Community Bank, Member FDIC, under license by Mastercard International.

-

It combines the functionalities of a debit card and a savings account, allowing users to manage their money more efficiently.

-

Users can earn interest on their savings directly through the card, making it a dual-purpose financial tool.

-

The card offers no-fee overdraft protection, which can be a lifesaver in unexpected situations.

-

It provides cashback rewards on everyday purchases, helping users save money while they spend.

Security Features of ONE Debit Card

Security is a top priority for any financial tool. The ONE debit card incorporates several advanced security features to protect users' funds and personal information.

-

The card uses EMV chip technology, which provides enhanced security compared to traditional magnetic stripe cards.

-

It offers instant transaction alerts, allowing users to monitor their spending in real-time.

-

Users can lock and unlock their card through the ONE app, providing an extra layer of security.

-

The card supports two-factor authentication for added protection during online transactions.

-

It includes zero liability protection, ensuring users are not held responsible for unauthorized transactions.

Benefits of Using ONE Debit Card

The ONE debit card offers numerous benefits that make it a valuable addition to anyone's wallet. These benefits go beyond basic banking features, providing users with added convenience and financial perks.

-

The card has no monthly fees, making it a cost-effective option for managing finances.

-

It offers free ATM withdrawals at over 55,000 Allpoint ATMs worldwide.

-

Users can set up direct deposits, allowing for seamless transfer of funds into their account.

-

The card supports mobile payments, including Apple Pay, Google Pay, and Samsung Pay.

-

It provides budgeting tools within the ONE app, helping users track their spending and savings goals.

How to Get a ONE Debit Card

Obtaining a ONE debit card is a straightforward process. Here are some key steps and requirements for getting started with this versatile financial tool.

-

Users must be at least 18 years old and have a valid Social Security number.

-

The application process can be completed online through the ONE website or app.

-

There is no credit check required to open an account, making it accessible to a wide range of users.

-

Once approved, the card is typically delivered within 7-10 business days.

-

Users can activate their card through the ONE app or by calling customer service.

Managing Your ONE Debit Card

Managing your ONE debit card is simple and convenient, thanks to the user-friendly ONE app. Here are some tips for effectively managing your card and account.

-

The ONE app allows users to view their transaction history and account balance in real-time.

-

Users can set up automatic transfers to their savings account, ensuring consistent savings growth.

-

The app provides spending insights, helping users identify areas where they can cut back and save more.

-

Users can easily update their personal information, such as address and phone number, through the app.

-

The app also offers customer support chat, providing quick assistance for any issues or questions.

Additional Features of ONE Debit Card

The ONE debit card comes with several additional features that enhance its functionality and user experience. These features make it a versatile and valuable financial tool.

-

The card offers virtual card numbers for online purchases, providing an extra layer of security.

-

Users can create multiple savings pockets within their account, each with its own goal and interest rate.

-

The card supports peer-to-peer payments, allowing users to send money to friends and family easily.

-

It offers bill pay services, enabling users to pay their bills directly from their ONE account.

-

The card includes travel benefits, such as no foreign transaction fees and travel insurance coverage.

Customer Support for ONE Debit Card

Good customer support is essential for any financial product. The ONE debit card offers robust customer support options to ensure users have a positive experience.

-

Users can contact customer support via phone, email, or chat through the ONE app.

-

The ONE website offers a comprehensive FAQ section, addressing common questions and issues.

-

Customer support is available 24/7, providing assistance whenever needed.

-

The ONE app includes a help center with guides and tutorials on using the card and app features.

-

Users can also access community forums for peer support and advice from other ONE debit card users.

The Final Scoop on ONE Debit Card

ONE debit card packs a punch with its unique features. From no hidden fees to cashback rewards, it’s designed to make your financial life easier. You can manage your money seamlessly, track spending, and even save automatically. It’s not just a card; it’s a tool for smarter financial decisions.

Security is top-notch with advanced encryption and fraud protection. Plus, the integration with popular payment platforms means you can use it almost anywhere. Whether you’re shopping online or in-store, ONE debit card has got your back.

In a nutshell, ONE debit card offers convenience, security, and rewards all in one package. It’s a solid choice for anyone looking to streamline their finances and get more out of their spending. Give it a try and see how it can make a difference in your daily life.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.