TSM stock, short for Taiwan Semiconductor Manufacturing Company, is a hot topic among investors. Why is TSM stock so popular? TSM is the world's largest dedicated semiconductor foundry, producing chips for tech giants like Apple, Nvidia, and AMD. This makes it a crucial player in the tech industry. Investors are drawn to TSM because of its strong market position, consistent growth, and innovative technology. With the rise of 5G, AI, and electric vehicles, demand for semiconductors is skyrocketing. TSM's stock performance reflects this trend, showing impressive gains over the years. Understanding TSM stock can help investors make informed decisions in the ever-evolving tech landscape.

What is TSM Stock?

TSM stock refers to the shares of Taiwan Semiconductor Manufacturing Company (TSMC), a leading player in the semiconductor industry. TSMC is renowned for its cutting-edge technology and significant role in global electronics manufacturing.

-

TSMC is the world's largest dedicated independent semiconductor foundry. This means they manufacture chips for other companies without designing any themselves.

-

Founded in 1987, TSMC has grown exponentially. Over the years, it has become a cornerstone of the tech industry, providing essential components for everything from smartphones to supercomputers.

-

TSMC's headquarters are in Hsinchu, Taiwan. This city is known as Taiwan's Silicon Valley, home to many tech giants and startups.

TSMC's Market Influence

TSMC's influence on the market is profound, impacting various sectors and driving technological advancements.

-

TSMC supplies chips to major tech companies like Apple, AMD, and Nvidia. These partnerships highlight TSMC's critical role in the tech supply chain.

-

TSMC's market capitalization is over $500 billion. This makes it one of the most valuable companies globally, reflecting its importance in the tech industry.

-

TSMC holds a dominant market share of over 50% in the foundry market. This dominance underscores its pivotal role in semiconductor manufacturing.

Technological Advancements

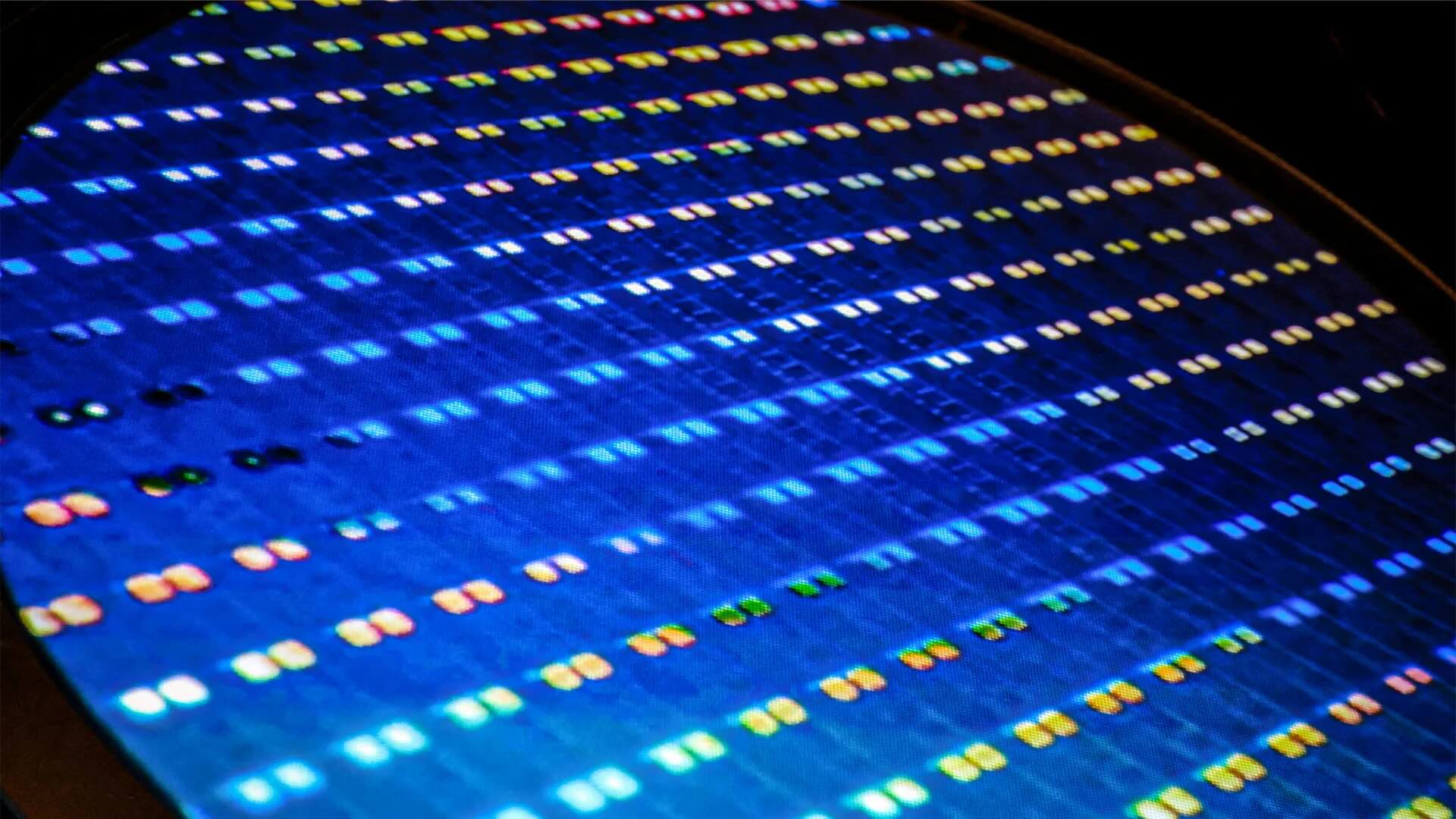

TSMC is at the forefront of technological innovation, constantly pushing the boundaries of what's possible in semiconductor manufacturing.

-

TSMC was the first to produce 7nm and 5nm chips. These advancements have set new standards for performance and efficiency in electronics.

-

TSMC is investing heavily in 3nm technology. This next-generation technology promises even greater performance improvements and energy efficiency.

-

TSMC's R&D spending is among the highest in the industry. This commitment to innovation ensures they remain leaders in semiconductor technology.

Financial Performance

TSMC's financial performance is a testament to its strategic vision and operational excellence.

-

TSMC reported revenues of over $45 billion in 2020. This impressive figure highlights the company's robust financial health.

-

TSMC's net income has consistently grown year over year. This growth reflects its successful business model and strong market demand.

-

TSMC pays regular dividends to its shareholders. This makes it an attractive investment for those seeking steady income.

Global Impact

TSMC's influence extends beyond just the tech industry, affecting global economies and technological progress.

-

TSMC is a key player in the global supply chain. Its chips are essential components in countless electronic devices worldwide.

-

TSMC's operations support thousands of jobs globally. This includes not only direct employees but also those in related industries and supply chains.

-

TSMC is committed to sustainability and reducing its environmental impact. Initiatives include reducing carbon emissions and increasing energy efficiency in their manufacturing processes.

Final Thoughts on TSM Stock

TSM stock has a lot going for it. Taiwan Semiconductor Manufacturing Company is a giant in the tech industry, producing chips for some of the biggest names out there. Their innovations keep them ahead of the game, making them a solid choice for investors. The company’s strong financials and market position make it a reliable pick. However, like any investment, it comes with risks. Geopolitical tensions and market fluctuations can impact stock performance. Staying informed about these factors is key. If you’re considering adding TSM to your portfolio, do your homework. Keep an eye on industry trends and company news. With the right approach, TSM stock could be a valuable addition to your investments. Happy investing!

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.