CMG stock, representing Chipotle Mexican Grill, has become a hot topic among investors. Ever wondered why? Chipotle has grown from a single restaurant in Denver to a global brand with over 2,500 locations. This rapid expansion has caught the eye of many in the stock market. But what makes CMG stock so intriguing? Is it the company's commitment to fresh ingredients, its innovative menu, or its ability to bounce back from setbacks? Investors are always on the lookout for stocks with strong growth potential, and CMG often tops the list. Let's dive into 38 fascinating facts about CMG stock that might just make you consider adding it to your portfolio.

What is CMG Stock?

Chipotle Mexican Grill, Inc., often abbreviated as CMG, is a popular fast-casual restaurant chain known for its burritos, bowls, and tacos. The company's stock, traded under the ticker symbol CMG, has been a favorite among investors due to its strong performance and growth potential.

-

CMG stock is traded on the New York Stock Exchange (NYSE). This means it is part of one of the largest stock exchanges in the world, making it accessible to a wide range of investors.

-

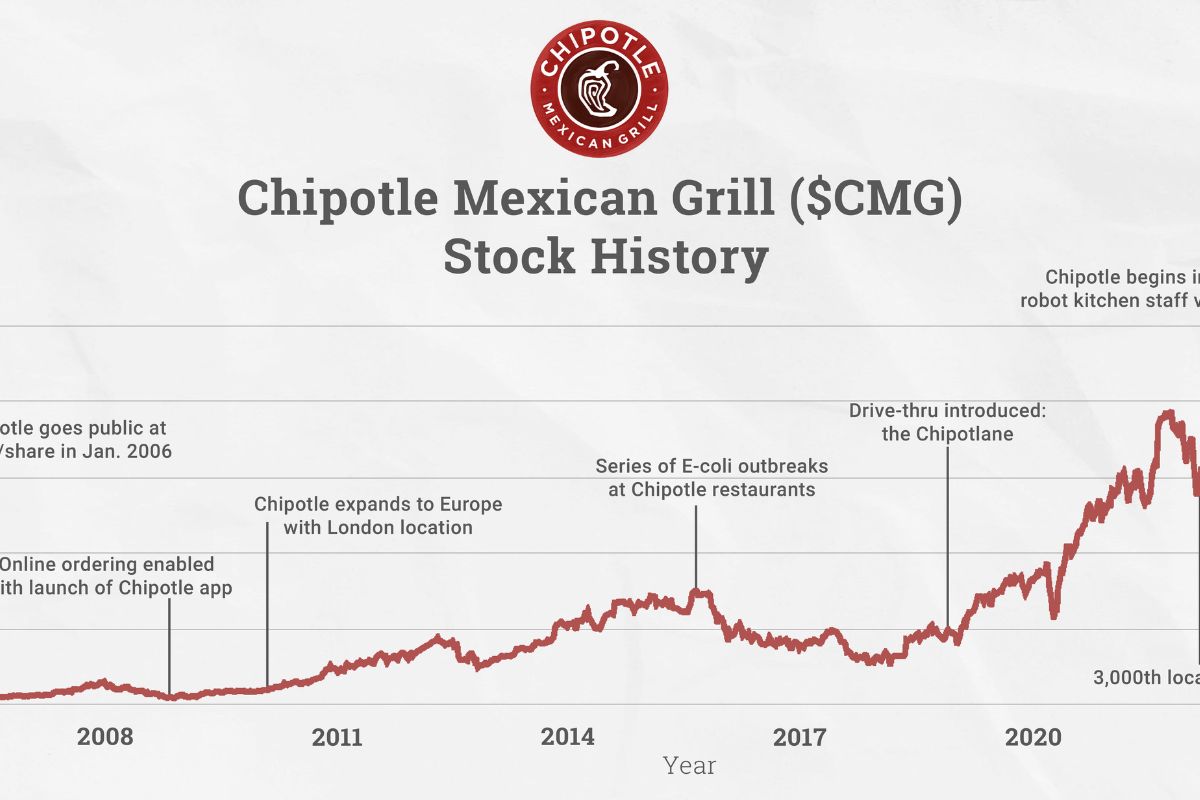

Chipotle went public on January 26, 2006. The initial public offering (IPO) was priced at $22 per share, but it opened at $45, more than doubling on its first day.

-

CMG stock has experienced significant growth since its IPO. From its initial price of $22, the stock has soared to over $1,500 per share as of 2023.

-

The company was founded by Steve Ells in 1993. Ells opened the first Chipotle in Denver, Colorado, with a vision to serve high-quality, fresh food quickly.

-

Chipotle focuses on "Food with Integrity." This means they prioritize using organic, locally sourced ingredients and responsibly raised meat.

Financial Performance of CMG Stock

Understanding the financial performance of CMG stock can provide insights into its growth and stability. Here are some key financial facts about Chipotle.

-

Chipotle's revenue for 2022 was approximately $7.5 billion. This represents a significant increase from previous years, showcasing the company's growth.

-

The company's net income for 2022 was around $653 million. This indicates profitability and efficient management.

-

Chipotle has a market capitalization of over $40 billion. Market cap is the total market value of a company's outstanding shares and is a key indicator of its size.

-

CMG has a price-to-earnings (P/E) ratio of around 60. This ratio helps investors determine the market value of a stock compared to the company's earnings.

-

The company has a strong balance sheet with minimal debt. This financial stability makes it an attractive option for investors.

CMG Stock and Market Trends

Market trends can significantly impact the performance of CMG stock. Here are some trends and factors that have influenced its performance.

-

The rise of health-conscious eating has benefited Chipotle. As more people seek healthier food options, Chipotle's focus on fresh ingredients has attracted more customers.

-

The COVID-19 pandemic accelerated digital sales. Chipotle adapted quickly by enhancing its online ordering and delivery services, leading to a surge in digital sales.

-

Chipotle's loyalty program, Chipotle Rewards, has over 20 million members. This program helps retain customers and encourages repeat business.

-

The company has been expanding its menu. New items like the quesadilla and cauliflower rice have attracted new customers and increased sales.

-

Sustainability initiatives have boosted the brand's image. Efforts like reducing waste and using renewable energy resonate with environmentally conscious consumers.

Challenges Faced by CMG Stock

Despite its success, CMG stock has faced several challenges over the years. Here are some notable ones.

-

Food safety issues in 2015 and 2016 hurt the brand. Outbreaks of E. coli and norovirus led to a decline in sales and stock price.

-

Rising food costs can impact profitability. As the cost of ingredients increases, it can squeeze profit margins.

-

Labor shortages have been a recent challenge. The restaurant industry has faced difficulties in hiring and retaining staff, affecting operations.

-

Competition from other fast-casual chains. Brands like Panera Bread and Qdoba offer similar dining experiences, creating a competitive market.

-

Economic downturns can affect consumer spending. During recessions, people may cut back on dining out, impacting sales.

Future Prospects of CMG Stock

Looking ahead, CMG stock has several growth opportunities. Here are some factors that could influence its future performance.

-

International expansion is a key focus. Chipotle has been opening new locations outside the U.S., particularly in Canada and Europe.

-

Technological advancements in ordering and delivery. Innovations like AI-driven customer service and drone deliveries could enhance the customer experience.

-

Sustainability efforts continue to evolve. Chipotle aims to reduce its carbon footprint and improve supply chain transparency.

-

Menu innovation remains a priority. Introducing new items and limited-time offers can attract new customers and keep the menu exciting.

-

Partnerships and collaborations. Working with other brands and influencers can boost visibility and attract new audiences.

Interesting Facts About Chipotle

Beyond the stock market, Chipotle has some fascinating aspects that contribute to its unique brand.

-

Chipotle uses over 100,000 pounds of avocados daily. Guacamole is a fan favorite, and the company goes through a massive amount of avocados to meet demand.

-

The company has a "Cultivate Foundation." This nonprofit organization supports sustainable agriculture and family farming.

-

Chipotle was once owned by McDonald's. McDonald's invested in Chipotle in 1998 and helped it expand before divesting in 2006.

-

The name "Chipotle" comes from a smoked, dried jalapeño pepper. This ingredient is commonly used in Mexican cuisine.

-

Chipotle has a test kitchen called the NEXT Kitchen. Located in New York City, this is where new menu items are developed and tested.

CMG Stock in Pop Culture

Chipotle has made its mark not just in the culinary world but also in pop culture. Here are some fun facts about its influence.

-

Chipotle has been featured in TV shows and movies. Shows like "South Park" and movies like "The Internship" have included Chipotle references.

-

The company has a strong social media presence. With millions of followers across platforms, Chipotle engages with fans through memes, promotions, and more.

-

Chipotle has collaborated with celebrities. Stars like David Dobrik and Shawn Mendes have partnered with the brand for special promotions.

-

The "Chipotle Burrito Builder" game on Roblox. This game allows players to create virtual burritos, blending gaming with brand engagement.

-

Chipotle's Halloween promotion, "Boorito." Every Halloween, customers can get discounted burritos by dressing up in costumes.

CMG Stock and Investor Sentiment

Investor sentiment plays a crucial role in the stock market. Here are some insights into how investors view CMG stock.

-

Analysts often rate CMG stock as a "buy." Many financial analysts believe in the company's growth potential and recommend purchasing the stock.

-

Institutional investors hold a significant portion of CMG stock. Large investment firms and mutual funds see value in Chipotle's long-term prospects.

-

The stock has a loyal investor base. Many investors have held onto CMG stock for years, benefiting from its consistent growth.

Final Thoughts on CMG Stock

CMG stock has shown impressive growth over the years. With its focus on fresh ingredients and a strong brand, Chipotle has carved out a unique spot in the fast-casual dining sector. Investors have seen substantial returns, thanks to the company's innovative strategies and commitment to quality. However, like any investment, it's important to stay informed about market trends and company performance. Keep an eye on quarterly earnings reports and any news that might impact the stock. Diversifying your portfolio can also help manage risk. Whether you're a seasoned investor or just starting out, understanding the factors that drive CMG's success can help you make more informed decisions. Remember, investing always carries risks, so do your homework and consult with financial advisors when needed. Happy investing!

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.