Carbon credit trading might sound complicated, but it's actually a straightforward way to help the environment. Carbon credits are permits that allow companies to emit a certain amount of carbon dioxide or other greenhouse gases. If they emit less, they can sell their extra credits to other companies. This system encourages businesses to reduce their emissions. But why should you care? Because it impacts everything from the air we breathe to the prices we pay for goods. Understanding carbon credit trading can help you make informed choices about the products you buy and the companies you support. Ready to learn more? Let's dive into 25 fascinating facts about carbon credit trading!

What is Carbon Credit Trading?

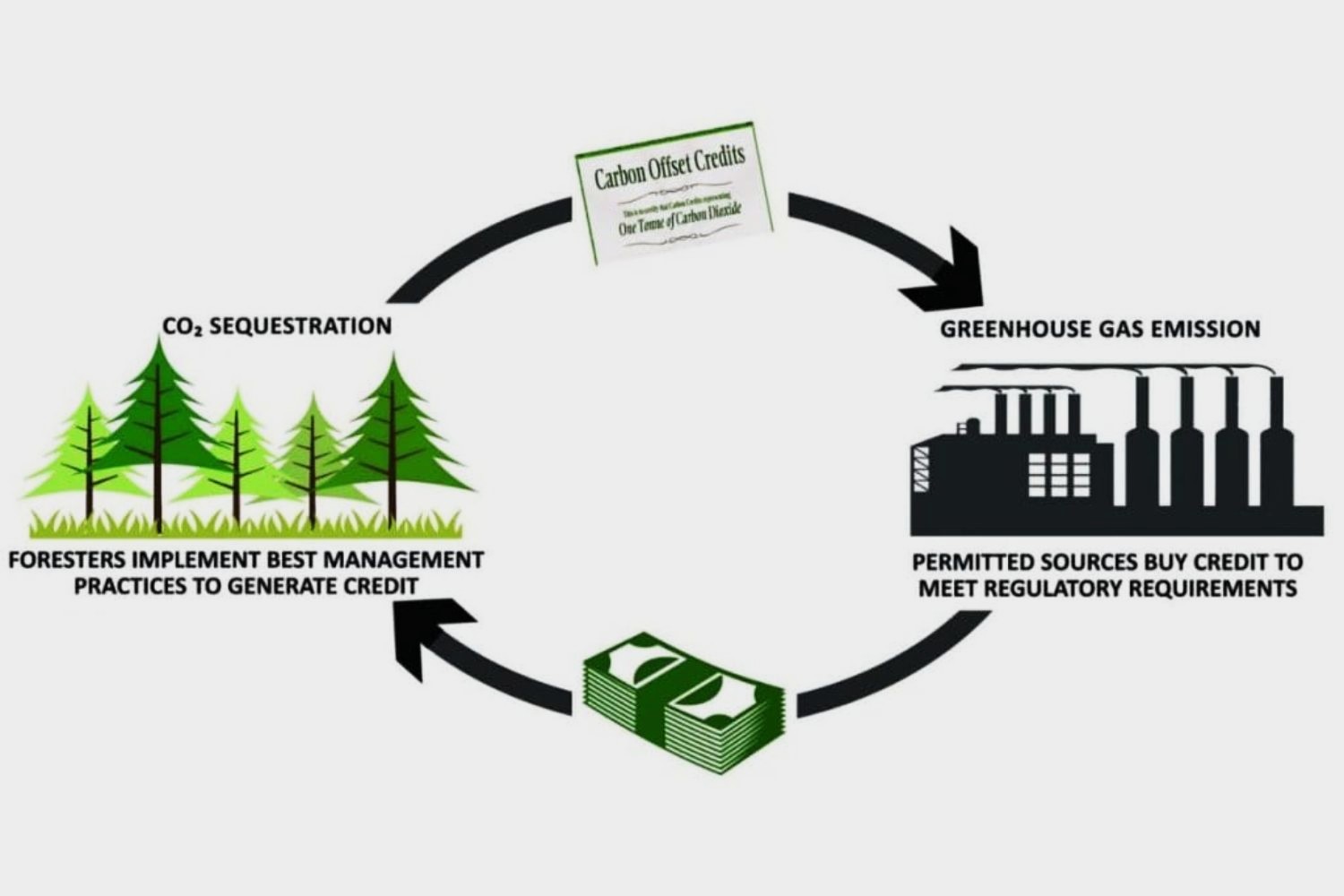

Carbon credit trading is a market-based system aimed at reducing greenhouse gases. Companies buy and sell carbon credits to meet emission reduction targets. Each credit represents one ton of carbon dioxide or equivalent gases.

- Carbon credits originated from the Kyoto Protocol, an international treaty adopted in 1997 to combat climate change.

- One carbon credit equals one metric ton of carbon dioxide or an equivalent amount of other greenhouse gases.

- Cap-and-trade systems are a common method for carbon credit trading. Governments set a cap on emissions and issue credits that companies can trade.

- Voluntary carbon markets allow companies and individuals to buy credits to offset their emissions, even if not legally required.

- Carbon offset projects include renewable energy, reforestation, and energy efficiency initiatives that reduce or absorb emissions.

How Does Carbon Credit Trading Work?

Understanding the mechanics of carbon credit trading helps grasp its impact on the environment and economy. Here's a breakdown of how it functions.

- Emission caps are set by governments or international bodies to limit the total amount of greenhouse gases that can be emitted.

- Companies receive or buy credits based on their emission levels. Those who emit less can sell their extra credits to those who need more.

- Trading platforms facilitate the buying and selling of carbon credits, similar to stock exchanges.

- Verification agencies ensure that emission reductions are real and measurable before issuing credits.

- Compliance markets require companies to meet legal emission limits, while voluntary markets cater to those who want to offset their carbon footprint.

Benefits of Carbon Credit Trading

Carbon credit trading offers several advantages for both the environment and businesses. Here are some key benefits.

- Encourages emission reductions by putting a price on carbon, making it financially beneficial to lower emissions.

- Promotes innovation in green technologies and sustainable practices as companies seek cost-effective ways to reduce emissions.

- Supports developing countries through carbon offset projects that bring investment and technology transfer.

- Creates financial incentives for companies to invest in renewable energy and other low-carbon solutions.

- Enhances corporate responsibility by encouraging businesses to take proactive steps in addressing climate change.

Challenges and Criticisms

Despite its benefits, carbon credit trading faces several challenges and criticisms. Understanding these issues is crucial for improving the system.

- Market volatility can make carbon credit prices unpredictable, affecting investment decisions.

- Fraud and manipulation are concerns, as some companies may falsely claim emission reductions to earn credits.

- Uneven distribution of benefits, with some regions or industries gaining more than others.

- Complex regulations can make it difficult for companies to navigate the system and comply with requirements.

- Limited impact on global emissions if caps are set too high or enforcement is weak.

Future of Carbon Credit Trading

The future of carbon credit trading looks promising, with potential for growth and improvement. Here are some trends to watch.

- Increased participation from countries and companies as climate change becomes a more pressing issue.

- Technological advancements in monitoring and verification to ensure the integrity of carbon credits.

- Integration with other environmental markets like water and biodiversity credits for a more holistic approach to sustainability.

- Stronger regulations and enforcement to address fraud and ensure real emission reductions.

- Greater public awareness and demand for carbon-neutral products and services, driving the growth of voluntary markets.

The Bottom Line on Carbon Credit Trading

Carbon credit trading is a powerful tool in the fight against climate change. It allows companies to offset their emissions by investing in green projects. This system not only helps reduce the overall carbon footprint but also encourages innovation in sustainable practices. By understanding how carbon credits work, businesses can make more informed decisions that benefit both the environment and their bottom line.

Individuals can also contribute by supporting companies that participate in carbon credit trading. Every small action adds up to a significant impact. As awareness grows, the market for carbon credits will likely expand, making it easier for everyone to participate in creating a more sustainable future.

So, whether you're a business owner or just someone who cares about the planet, carbon credit trading offers a practical way to make a difference. Let's all do our part to protect our world.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.