Payday loans are a form of short-term assistance designed to meet urgent needs or bridge the gap between paychecks. Many people turn to them when they face financial emergencies. However, these loans are often associated with high interest rates and fast payback times, making them difficult to manage.

Therefore, it’s important to know what you’re dealing with before going into debt. Whether you want to take out a payday loan and get approved for it without unpredictabilities or just looking for more information about this form of debt, here are 11 surprising facts about these products. Read on to avoid unpleasant turn-ups during the borrowing process.

1. Extremely High Interest Rates

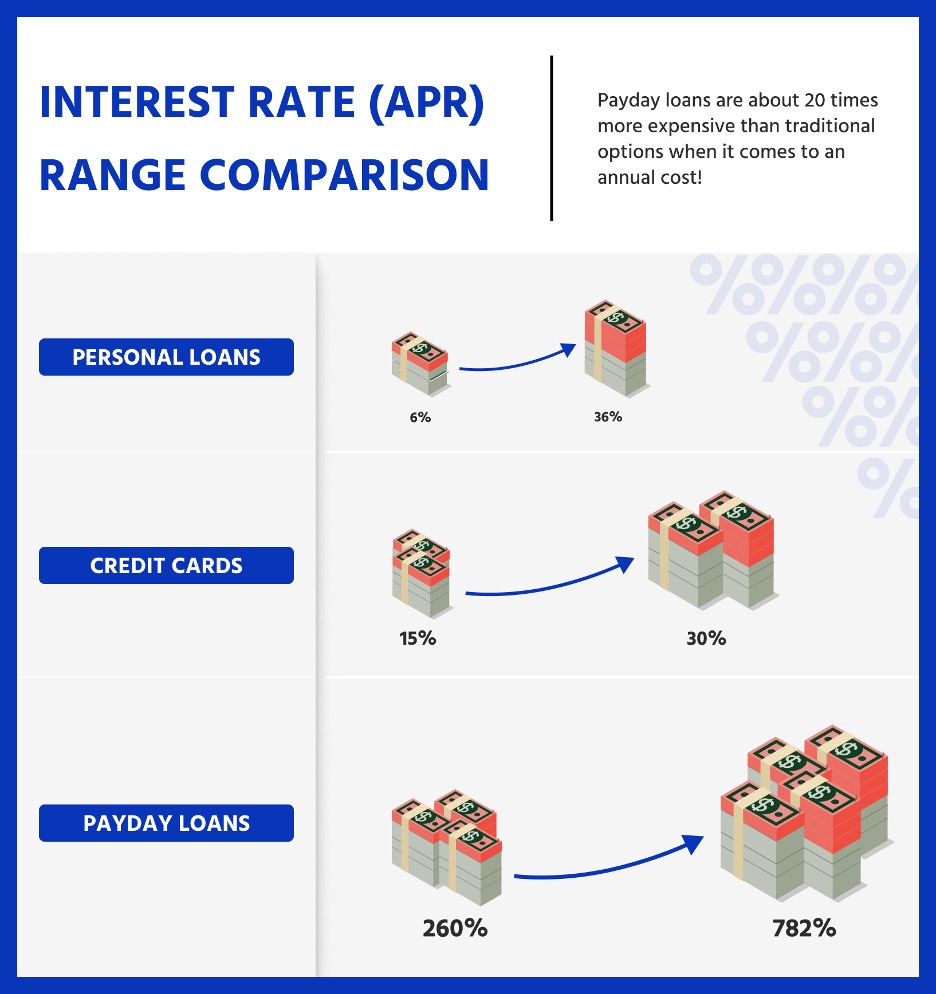

Payday loans are high-interest loan products. The fees range from $10 to $30 per each $100 borrowed. These sums might seem small to many until they translate to an annual percentage rate (APR) of 260% to 782%.

An APR shows the real cost of your loan per entire year and allows you to fairly compare various financial products. In contrast, an APR on personal loans range between 6% and 36%, while credit card APRs are typically 15% to 30%. Thus, payday loans are about 20 times more expensive than traditional options when it comes to an annual cost.

2. Only Small Amounts Are Available

Payday loans offer relatively small sums, mainly from $100 to $1,000. The amounts depend on the state legislation and a borrower’s income. Limited amounts make these loans suitable primarily for short-term emergencies or minor expenses, such as grocery bills or insignificant car repairs.

3. Short Repayment Periods

Payday loans need to be repaid quickly, usually within 2 to 4 weeks. This short time limit often puts a lot of stress on borrowers, especially those who already face financial problems. If you fail to repay the money on time, you will be charged extra fees and may get into a cycle of debt. Plus, your credit score may go down.

4. Legal Status Varies by State

Laws and regulations regarding payday loans vary from one state to another, mainly due to differences in legal systems. In particular, 13 states in America, including New York and Georgia, have prohibited payday loans. However, payday loans are still legal in 37 states, with some of them setting caps on interest rates and maximum loan amounts to protect borrowers from hefty charges.

5. Hidden Fees and Additional Costs

Payday loans have other additional costs, such as application or processing fees. While they must be clearly outlined in a loan agreement, some lenders hide them in fine print. As a result, borrowers might not understand what they are going into when signing their agreements. There are also fees that only arise under certain circumstances, such as early or late payment, which can also affect the final cost of your loan.

6. Impact on Credit Score

A payday loan also can potentially affect your credit scores in some situations. Payday lenders usually don’t report payments to major credit reporting bureaus. Therefore, such loans can’t help you build credit. However, if you default, your account may be sent to a collection agency. Collectors typically report your overdue debt to credit bureaus, which will affect your score.

7. Targeting Vulnerable Populations

Payday loans are the type of products offered to needy people who can’t obtain traditional bank loans. They are mostly in a bad financial situation and have very limited options to consider when they face financial emergencies. As a result, payday lenders try to benefit from their vulnerability by charging too high interest rates and offering inconvenient terms. It puts borrowers in a rather helpless position. Many of them become unable to pay back the loan and find themselves in a cycle of debt.

8. Quick Funding

Payday loans aim to provide borrowers with quick money. That’s why the entire loan process is typically very simple and fast. Once the loan application is approved, the money is usually deposited into your bank account within one business day. Some lenders might be able to send you the loan funds in minutes, especially if you apply early in the morning.

9. The Debt Cycle Trap

Payday loans are extremely easy to get. As a result, many people with limited choice borrow more than they can afford and get trapped in a debt cycle. This cycle starts when a borrower cannot pay off the money when due and is forced to extend their loan or take out another one to cover the existing debt. The CFPB study shows that 4 out of 5 payday loans get rolled over within two weeks. This always involves extra fees. As a result, borrowers may find themselves owing more in interest then they’ve initially borrowed.

10. Some Forms of Payday Loans Are Not Subject to State Laws

Tribal payday loans are short-term, small-amount, unsecured loans offered by lenders who operate on Native sovereign territories. These loans are not regulated by the state laws because tribes are considered as separate nations with their own laws. These loans can be legally offered in states where payday lending is prohibited and often have higher interest rates and fees than regular payday loans.

11. Payday Loan Industry Size and Profitability

Currently, payday loan stores are located in the physical premises in 32 US states. The payday loan business in the U.S is a huge and growing market. According to the Pew Charitable Trust research, 12 million Americans take out payday loans each year, spending $9 billion on loan fees. The average payday loan borrower is in debt for 5 months of the year and spends about $520 in fees to repeatedly borrow $375. The average fee at a storefront loan business is $55 per two weeks.

Bottom Line

Payday loans seem like an easy way to get fast cash, but they have many hidden problems that can worsen your situation. On the surface, the interest rates and fees sound decent. But when you do the math, you realize you’re paying way more than you thought. These loans can trap you in debt that just keeps piling up.

Therefore, you should use payday loans only as a last resort. Look into other options first, even if it means cutting back on expenses for a while. Talk to a financial advisor before resorting to payday loans – they can help you find better solutions.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.