Angelo Mozilo is a name that has become synonymous with the real estate industry and the American dream of homeownership. As the former CEO and co-founder of Countrywide Financial Corporation, Mozilo was at the forefront of the housing boom and subsequent financial crisis of 2008. But there is much more to the man than his controversial role in the mortgage crisis. In this article, we will explore 24 surprising facts about Angelo Mozilo that shed light on his career, personal life, and the impact he has had on the world of finance. From his humble beginnings to his rise as one of the most influential figures in the mortgage industry, prepare to be captivated by the intriguing story of Angelo Mozilo.

Key Takeaways:

- Angelo Mozilo co-founded Countrywide Financial, popularized subprime mortgages, and faced controversy during the 2008 financial crisis, leaving a controversial legacy in the mortgage industry.

- Despite industry recognition, Mozilo’s actions led to increased regulations in the housing market and a tarnished public image, impacting his financial worth and ongoing scrutiny.

Early Life

Angelo Mozilo was born on March 6, 1938, in New York City. He grew up in the Bronx and came from a modest background.

Career Start

Mozilo began his career in the mortgage industry at the age of 14, working as a part-time office boy in a small lending company.

Co-Founder of Countrywide Financial

In 1969, Mozilo co-founded Countrywide Financial Corporation, which would go on to become one of the largest mortgage companies in the United States.

Pioneer of Subprime Mortgages

Mozilo played a significant role in popularizing subprime mortgages, which allowed people with poor credit to obtain home loans.

Rapid Expansion

Under Mozilo’s leadership, Countrywide experienced rapid growth and expanded its reach across the country.

Innovative Marketing Strategies

Mozilo implemented innovative marketing strategies, such as offering no-down-payment mortgages and relaxed credit standards, to attract more borrowers.

Acquisition of IndyMac Bank

In 2008, Countrywide acquired IndyMac Bank, renaming it Bank of America Home Loans.

Financial Crisis Controversy

Mozilo faced a great deal of controversy during the 2008 financial crisis. He was accused of orchestrating risky lending practices that contributed to the collapse of the housing market.

Settlement with the SEC

In 2010, Mozilo reached a settlement with the Securities and Exchange Commission (SEC) over allegations of securities fraud and insider trading. He agreed to pay a fine of $67.5 million.

Resignation from Countrywide

In 2008, Mozilo stepped down as CEO of Countrywide Financial amidst the company’s financial difficulties.

Personal Criticism

Mozilo faced personal criticism for his role in the financial crisis, with many blaming him for the economic downturn and the subsequent mortgage market collapse.

Sale of Countrywide Financial

In 2008, Bank of America acquired Countrywide Financial, marking the end of Mozilo’s tenure with the company.

Philanthropic Ventures

After retiring, Mozilo focused on philanthropic ventures, supporting causes such as education, healthcare, and affordable housing.

Federal Civil Lawsuit

In 2009, the U.S. Securities and Exchange Commission filed a federal civil lawsuit against Mozilo, accusing him of insider trading and misleading investors.

Impact on the Mortgage Industry

Mozilo’s leadership at Countrywide Financial had a profound impact on the mortgage industry, shaping its landscape and influencing lending practices.

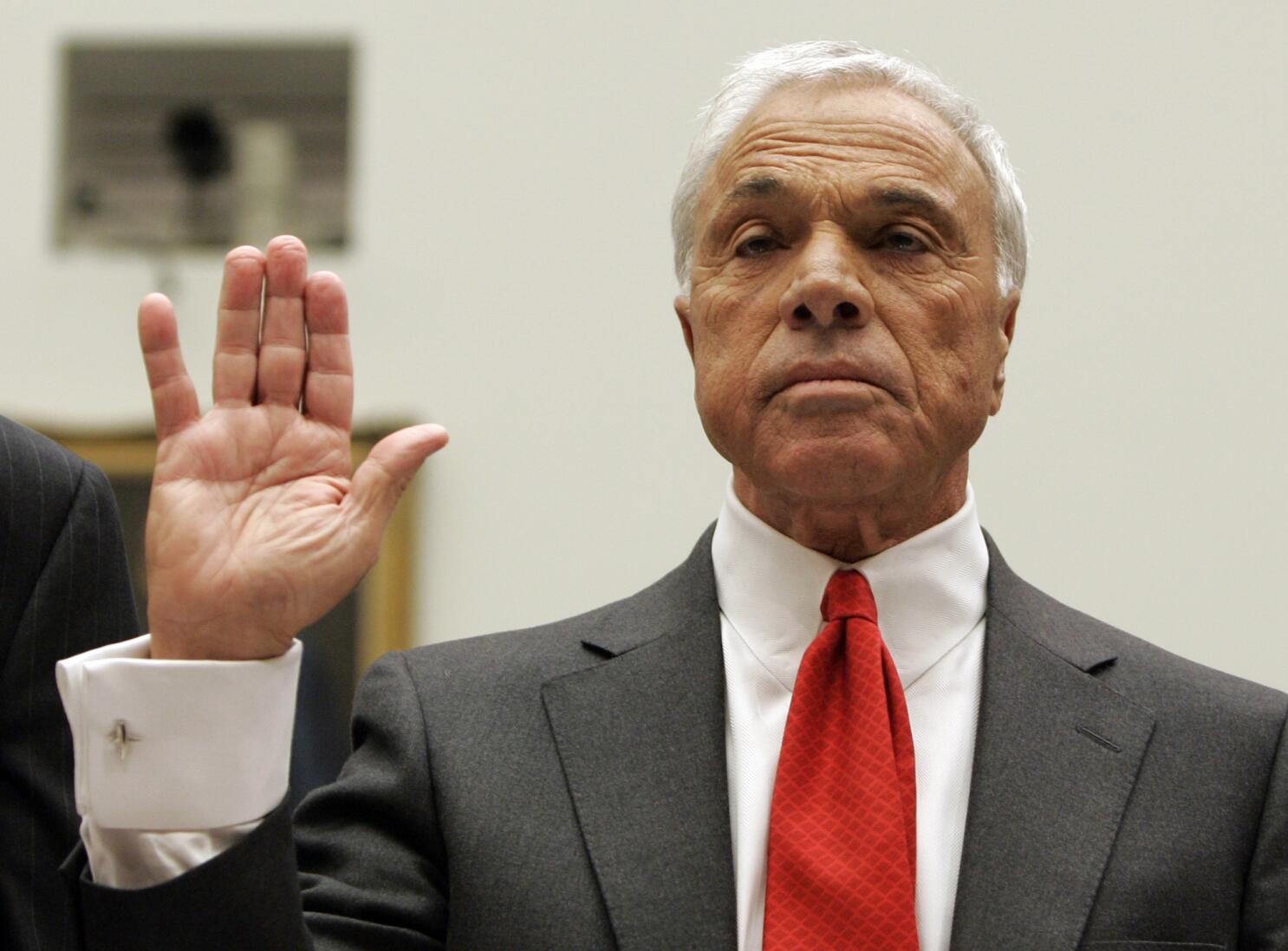

Congressional Testimony

Angelo Mozilo testified before the U.S. Congress in 2010, defending his actions during the financial crisis and denying any wrongdoing.

Industry Recognition

Despite the controversies surrounding his career, Mozilo received several industry accolades and was recognized as a prominent figure in the mortgage industry.

Retirement

Mozilo officially retired from the mortgage industry in 2008, following the acquisition of Countrywide Financial by Bank of America.

Legal Settlements

Mozilo reached various legal settlements related to his actions during the financial crisis, highlighting the ongoing repercussions of his decisions.

Public Image

Mozilo’s public image has been tarnished by the events surrounding the financial crisis, with many viewing him as a symbol of corporate greed and the housing market collapse.

Impact on Housing Market Regulations

The fallout from the housing market collapse and the practices associated with subprime mortgages led to increased regulations and stricter lending standards in the mortgage industry.

Financial Consequences

Mozilo’s financial worth took a significant hit following the financial crisis, with the decline in value of his Countrywide Financial stock and the payment of legal settlements.

Continued Scrutiny

Even after his retirement, Mozilo continues to face scrutiny and criticism for his role in the events leading up to the financial crisis.

Legacy in the Mortgage Industry

Angelo Mozilo’s legacy in the mortgage industry remains controversial, with his name often mentioned in discussions about the causes and consequences of the financial crisis.

Conclusion

In conclusion, Angelo Mozilo is a fascinating figure in the world of finance and entrepreneurship. His journey from humble beginnings to becoming a prominent mortgage industry leader is truly inspiring. From revolutionizing the lending process to his involvement in the subprime mortgage crisis, Mozilo’s impact on the industry cannot be denied. Despite the controversies surrounding his career, Mozilo’s contributions and achievements cannot be overlooked. Whether you admire him or critique him, Angelo Mozilo’s story serves as a reminder of the complexities and challenges faced by influential figures in the business world.

FAQs

Q: Who is Angelo Mozilo?

A: Angelo Mozilo is a prominent American business executive and entrepreneur who co-founded Countrywide Financial Corporation, one of the largest mortgage lending companies in the United States.

Q: What is Angelo Mozilo known for?

A: Mozilo is best known for revolutionizing the lending process and playing a significant role in the subprime mortgage crisis, which occurred in the late 2000s.

Q: How did Angelo Mozilo start his career?

A: Mozilo started his career in the mortgage industry by working as a loan officer. He later co-founded Countrywide Financial Corporation in 1969, which grew to become the largest residential mortgage lender in the United States.

Q: What was Angelo Mozilo’s role in the subprime mortgage crisis?

A: Angelo Mozilo and Countrywide Financial Corporation played a significant role in the subprime mortgage crisis by originating and securitizing high-risk mortgages, which ultimately contributed to the collapse of the housing market and the global financial crisis of 2008.

Q: What is Angelo Mozilo’s net worth?

A: As of 2021, Angelo Mozilo’s net worth is estimated to be around $600 million. However, it’s worth mentioning that his net worth has significantly decreased over the years due to legal settlements and the fall of Countrywide Financial Corporation.

Q: Has Angelo Mozilo faced any legal issues?

A: Yes, Angelo Mozilo has faced several legal issues related to the subprime mortgage crisis. In 2010, he agreed to pay $67.5 million to settle SEC charges of securities fraud and insider trading.

Q: What is Angelo Mozilo doing now?

A: After retiring from Countrywide Financial Corporation in 2008, Angelo Mozilo has largely stayed out of the public eye. He has focused on his private investments and philanthropic activities.

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.