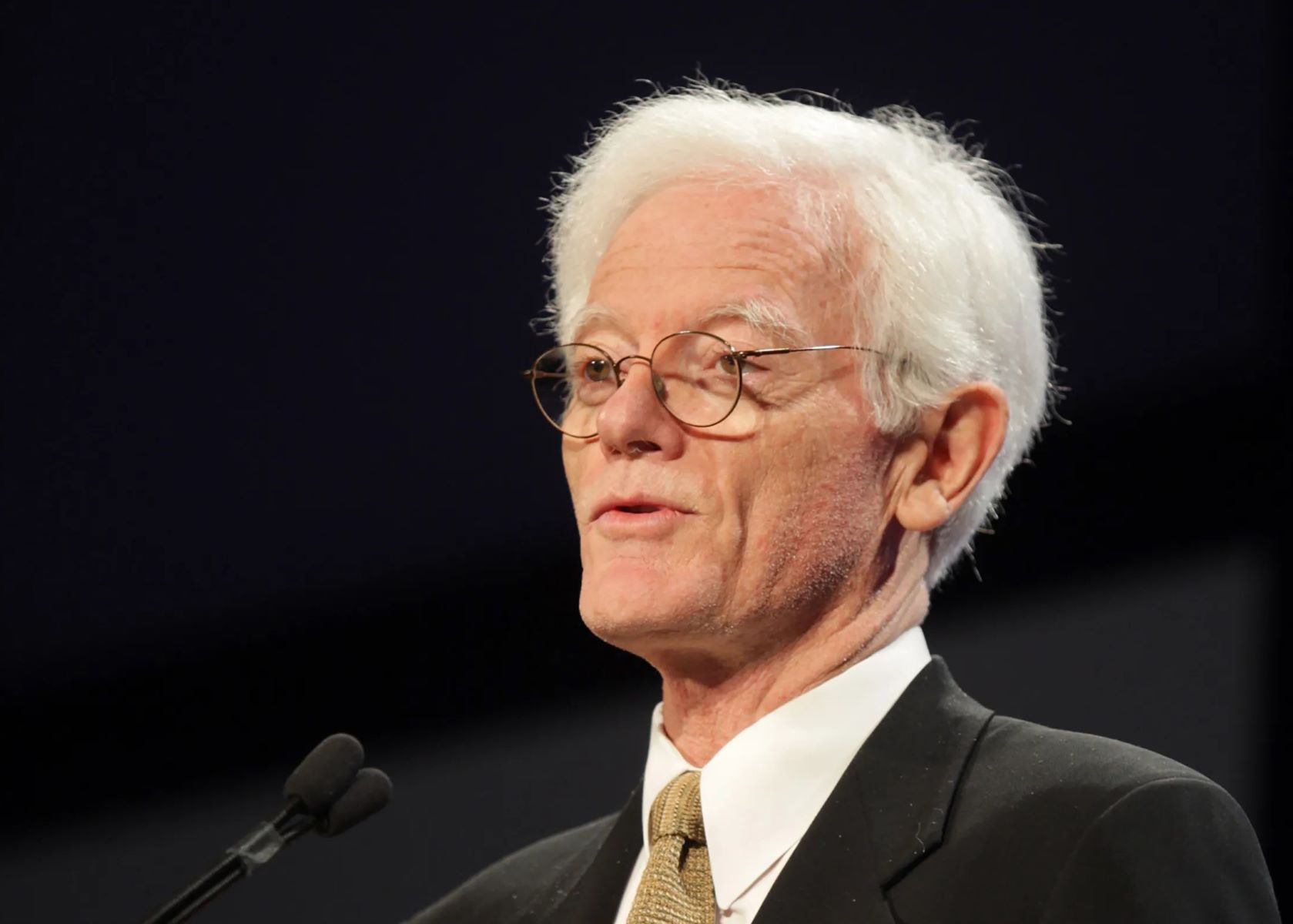

Who is Peter Lynch? A legendary figure in the world of investing, Lynch is celebrated for his remarkable success as a fund manager and his influential investment philosophy. Born in Newton, Massachusetts, in 1944, Lynch's journey began as a young caddy, where he first encountered the world of stocks. His career took off when he joined Fidelity Investments, eventually managing the Magellan Fund, which he transformed into one of the most successful mutual funds ever. Lynch's investment mantra, "buy what you know," encourages individual investors to leverage their personal experiences and insights. His knack for identifying "ten-bagger" stocks—those that increase tenfold in value—cemented his reputation. Beyond finance, Lynch is a philanthropist, author, and mentor, leaving a lasting legacy in both the investment industry and his community. His story continues to inspire countless investors to take charge of their financial futures.

Key Takeaways:

- Peter Lynch's early life and career at Fidelity shaped his legendary success as an investor, inspiring individual investors to "invest in what you know" and prioritize long-term perspective.

- Lynch's remarkable success managing the Magellan Fund, his philanthropy, and his impact on finance and community reflect his commitment to empowering individual investors and giving back to society.

Early Life and Education

Peter Lynch's journey to becoming a legendary investor began in Newton, Massachusetts. His early experiences shaped his future in finance.

-

Birth and Family: Born on January 19, 1944, in Newton, Massachusetts, Lynch faced early challenges when his father, a Boston University math professor, passed away from brain cancer when Peter was just ten.

-

Caddying at Brae Burn: As a young caddy at Brae Burn Country Club, Lynch listened to executives discuss stocks, sparking his interest in the stock market.

-

College and Military Service: He attended Boston College, graduating in 1965 with degrees in history, psychology, and philosophy, and later earned an MBA from Wharton in 1968. He also served in the Army ROTC from 1968 to 1970.

Career Beginnings

Lynch's career at Fidelity Investments set the stage for his future success as a fund manager.

-

First Job at Fidelity: In 1969, Lynch joined Fidelity Investments as an analyst, focusing on metals and textiles.

-

Director of Research: By 1974, he became Fidelity's director of research, gaining valuable experience in various industries.

Managing the Magellan Fund

Lynch's management of the Magellan Fund is legendary, with remarkable growth and returns.

-

Taking Over Magellan: In 1977, at 33, Lynch began managing the Magellan Fund, which grew from $20 million to $14 billion under his leadership.

-

Investment Philosophy: He believed individual investors had an edge over institutions, coining the phrase "invest in what you know."

-

"Buy What You Know": This slogan encouraged investors to focus on familiar companies, making investing more accessible.

-

Ten-Bagger and Three-Bagger: Lynch introduced these terms to describe stocks that returned ten or three times their original investment.

-

Long-Term Investing: He advocated for patience and a long-term perspective, emphasizing that short-term market fluctuations shouldn't deter investors.

Wealth and Philanthropy

Lynch's success allowed him to amass wealth and give back to society through philanthropy.

-

Net Worth: Lynch's investment career and fund management compensation have resulted in a net worth exceeding $400 million.

-

Philanthropy: He views philanthropy as an investment, supporting initiatives like First Night and City Year.

Author and Speaker

Lynch's books and public speaking have inspired countless investors.

-

Author: He wrote "One Up On Wall Street" and "Beating the Street," sharing his investment strategies.

-

Legacy in Finance: Lynch invented the price-to-earnings-growth (PEG) ratio, a valuable tool for value investors.

Personal Reflections

Even legends have regrets and reflections on their careers.

-

Regrets: Lynch has expressed regret over not investing in companies like Apple and Nvidia earlier.

-

Personal Life: He married Carolyn Ann Hoff in 1968, and they had three daughters. Carolyn passed away in 2015.

Continued Influence

Lynch's influence extends beyond his active management years.

-

Fidelity’s Vice Chairman: Though retired from managing the Magellan Fund, he remains vice chairman of Fidelity Management & Research Co.

-

Caddie Scholarship: His early work as a caddy earned him a scholarship, crucial for his education.

Notable Investments

Lynch's early investments set the stage for his future success.

-

Flying Tiger Airlines: One of his first successful investments, he bought shares at $7 and sold them for $80, funding his education.

-

Army ROTC Program: His military service provided valuable training and career development.

Expertise and Strategy

Lynch's expertise in analyzing industries contributed to his success.

-

Textiles and Metals Analyst: His first full-time job at Fidelity involved analyzing these industries.

-

Director of Research: As director, he followed textiles, metals, mining, and chemicals, laying the foundation for his future success.

Magellan Fund's Success

The Magellan Fund's growth under Lynch was extraordinary.

-

Early Years: When Lynch took over, the fund had $20 million in assets, growing exponentially under his management.

-

Annualized Return: He achieved an average annualized return of 29.2%, more than double the S&P 500's performance.

Philosophy on Investing

Lynch's investment philosophy emphasizes individual investors' advantages.

-

Individual Investors: He believes they can perform well by investing in what they know and understanding a company's fundamentals.

-

Importance of Research: Lynch stressed the significance of thorough research before investing.

-

Value Investing: He focused on analyzing companies with below-average price-to-earnings ratios.

-

PEG Ratio: Lynch invented the PEG ratio, a popular tool among value investors.

Legacy and Impact

Lynch's legacy extends beyond finance, impacting Boston and beyond.

-

Legacy in Boston: His contributions to Boston College, including a $20 million art donation, have significantly impacted the city's cultural scene.

-

Regrets Over Missed Opportunities: Lynch has expressed regret over missed investments in companies like Apple and Nvidia.

-

Philanthropic Milestones: His $20 million art donation to Boston College's McMullen Museum of Art reflects his commitment to cultural initiatives.

-

Community Service Programs: Lynch supports programs like City Year, which operates in 29 U.S. cities.

-

First Night Festival: His support for this festival, which began in Boston, has inspired similar events in over 200 communities.

-

Mentoring Young Analysts: Lynch continues to mentor young analysts at Fidelity, passing on his knowledge and experience.

-

Impact on Individual Investors: His strategies and success stories have motivated a generation of investors to take charge of their financial futures.

Lynch's Lasting Impact

Peter Lynch's journey from a young caddy to a legendary investor is nothing short of inspiring. His investment philosophy, centered around "buy what you know," has empowered countless individual investors to take charge of their financial futures. With a knack for spotting "ten-bagger" stocks and a focus on long-term investing, Lynch's strategies have left a lasting mark on the investment world. His remarkable success with the Magellan Fund, achieving an average annual return of 29%, showcases his exceptional skill and insight. Beyond his financial achievements, Lynch's commitment to philanthropy and mentoring young analysts highlights his dedication to giving back. His influence extends beyond numbers, shaping the way investors approach the market. Peter Lynch's legacy is a testament to the power of knowledge, patience, and a keen eye for opportunity, inspiring future generations to follow in his footsteps.

Frequently Asked Questions

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.