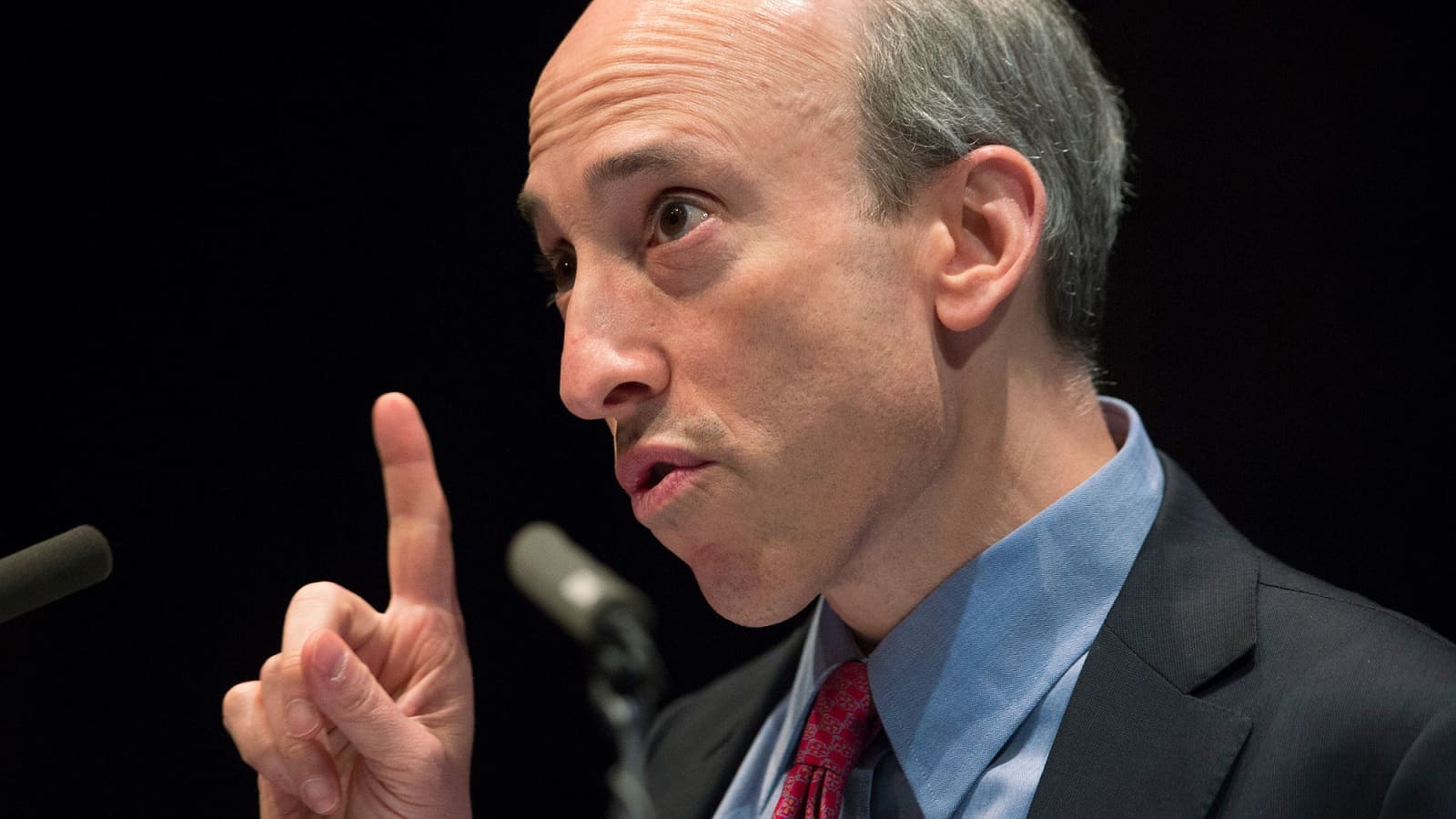

Who is Gary Gensler? Gary Gensler is a name that resonates in the world of finance and public service. Born on October 18, 1957, in Baltimore, Maryland, he has worn many hats, from a young partner at Goldman Sachs to the Chair of the U.S. Securities and Exchange Commission (SEC). Gensler's journey began with an economics degree from the Wharton School, leading to an 18-year stint at Goldman Sachs. His career took a pivotal turn when he transitioned to public service, contributing to significant financial reforms like the Sarbanes-Oxley Act and the Dodd-Frank Act. Today, he continues to shape financial regulations, focusing on market transparency, investor protection, and sustainable finance.

Key Takeaways:

- Gary Gensler, the current Chair of the U.S. Securities and Exchange Commission, has had a diverse and impactful career, from his early days at Goldman Sachs to his leadership at the CFTC and now at the SEC.

- Gensler's journey from Goldman Sachs to public service and academia, and finally to the SEC, showcases his commitment to financial regulation, investor protection, and corporate accountability.

Early Life and Education

Gary Gensler's journey began in Baltimore, Maryland, where he was born on October 18, 1957. His early experiences and education laid the foundation for his future success.

- Gary S. Gensler was born in Baltimore, Maryland.

- His father, Sam Gensler, was a cigarette and pinball machine vendor.

- Gensler attended the Wharton School at the University of Pennsylvania.

- He earned both his undergraduate degree in economics (1978) and his MBA (1979) from Wharton.

Career at Goldman Sachs

Gensler's career took off at Goldman Sachs, where he made significant strides in the financial world.

- Gensler joined Goldman Sachs in 1979.

- He became one of the youngest partners in the firm's history at age 30.

- He was involved in mergers and acquisitions, media group leadership, and fixed income & currency trading in Asia.

- Gensler led a team that advised the National Football League on a $3.6 billion deal for television sports rights.

- His last role at Goldman Sachs was co-head of finance, responsible for controllers and treasury worldwide.

Transition to Public Service

After leaving Goldman Sachs, Gensler transitioned to public service, where he continued to make an impact.

- President Bill Clinton nominated Gensler as Assistant Secretary of the Treasury for Financial Markets (1997-1999).

- He later served as Under Secretary of the Treasury for Domestic Finance (1999-2001).

- Gensler was awarded the Alexander Hamilton Award for his service at the Treasury Department.

- He helped write the Sarbanes-Oxley Act as a senior advisor to U.S. Senator Paul Sarbanes.

- Gensler served as the Chief Financial Officer for Hillary Clinton's 2016 presidential campaign.

Leadership at the CFTC

Gensler's role as Chairman of the Commodity Futures Trading Commission (CFTC) marked a significant period in his career.

- President-elect Barack Obama nominated Gensler to serve as the 11th Chairman of the CFTC.

- He served as CFTC Chairman from May 26, 2009, to January 3, 2014.

- Under his leadership, the CFTC wrote 68 new rules, orders, and guidances to regulate the swaps markets.

- The CFTC's reach extended from a $35 trillion futures market to a $400 trillion swaps market.

- Gensler led a massive investigation into the London Interbank Offered Rate (LIBOR) scandal.

- Several investment banking firms paid hundreds of millions of dollars in fines due to the LIBOR investigation.

Academic and Advisory Roles

Before his appointment as SEC Chair, Gensler continued to contribute to the financial world through academia and advisory roles.

- Gensler was a professor of practice of global economics and management at the MIT Sloan School of Management.

- He co-directed MIT’s Fintech@CSAIL.

- From 2017 to 2019, Gensler served as chair of the Maryland Financial Consumer Protection Commission.

SEC Chairmanship

As the current Chair of the U.S. Securities and Exchange Commission (SEC), Gensler has focused on strengthening market regulation and protecting investors.

- President Joseph R. Biden nominated Gensler to serve as Chair of the SEC on February 3, 2021.

- He was confirmed by the U.S. Senate on April 14, 2021, and sworn into office on April 17, 2021.

- Gensler has focused on integrating climate-related risks into business decisions.

- He has sought to require public companies to report details about their climate change risks, workforce management, and board members’ diversity.

- Gensler aimed to introduce new rules to fight greenwashing and other misleading ESG claims by investment funds.

- The SEC originally set an October 2021 target for proposing rules requiring companies to make specific disclosures about the demographic makeup of their workforces and the diversity of their boards.

- The SEC has faced several legal challenges under Gensler's leadership, including the Fifth Circuit’s ruling in National Association of Private Fund Managers v. SEC.

- Republican attorneys general from several states have sued the SEC over its climate rules and other regulations.

- Despite these challenges, the SEC has finalized more than 40 rules since 2021.

- Gensler is a key figure in the Biden administration, known for his commitment to left-of-center financial regulations.

- He has been involved in Democratic campaigns and has advised candidates on promoting left-of-center economic agendas.

- Gensler has been a strong advocate for investor protection and corporate accountability.

- During the 2008 financial crisis, Gensler played a crucial role in implementing reforms through the Dodd-Frank Act.

- Gensler’s tenure at Goldman Sachs was marked by significant achievements, including becoming one of the youngest partners in the firm’s history.

- At Goldman Sachs, Gensler headed the firm’s Media Group, advising media companies on strategic transactions.

- Gensler led fixed income & currency trading in Asia during his time at Goldman Sachs.

- Under Gensler’s leadership, the CFTC achieved bipartisan support for its rulemakings.

Gensler's Impact on Finance and Regulation

Gary Gensler's journey from Goldman Sachs to the SEC highlights his dedication to financial regulation and investor protection. His work on the Dodd-Frank Act, Sarbanes-Oxley Act, and LIBOR investigation showcases his commitment to transparency and accountability in the financial markets. As SEC Chair, Gensler has pushed for climate risk disclosures, workforce diversity, and anti-greenwashing regulations, despite facing legal challenges and industry pushback. His efforts have made significant strides in promoting sustainable finance and corporate accountability. Gensler's legacy will be remembered for his unwavering dedication to strengthening market regulation and protecting investors. His future impact will depend on overcoming ongoing legal challenges and navigating the political landscape. Regardless, his contributions have set a precedent for future regulatory initiatives, ensuring a more transparent and resilient financial system.

Frequently Asked Questions

Was this page helpful?

Our commitment to delivering trustworthy and engaging content is at the heart of what we do. Each fact on our site is contributed by real users like you, bringing a wealth of diverse insights and information. To ensure the highest standards of accuracy and reliability, our dedicated editors meticulously review each submission. This process guarantees that the facts we share are not only fascinating but also credible. Trust in our commitment to quality and authenticity as you explore and learn with us.